MARKET INSIGHT FOR THE WEEK ENDING October 6th

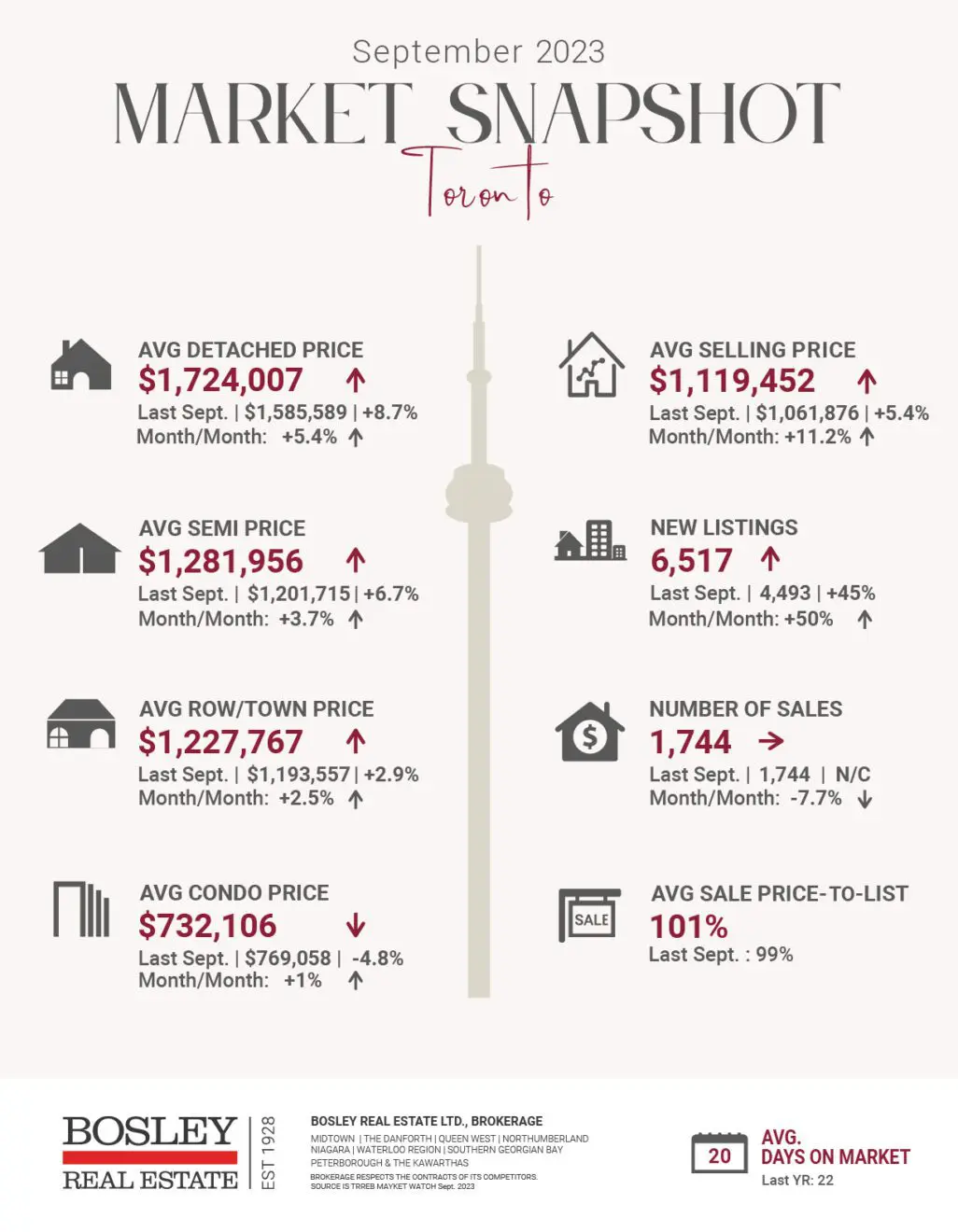

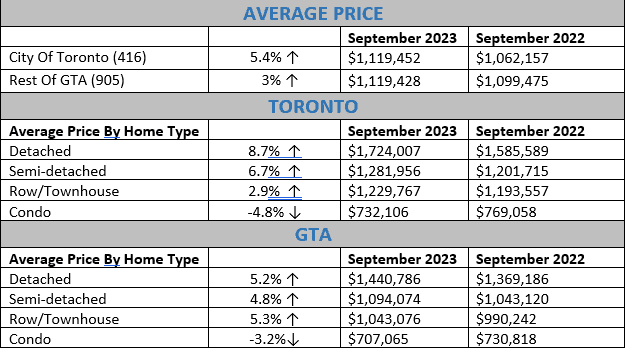

The impact of high borrowing costs, high inflation, uncertainty surrounding future Bank of Canada decisions, and slower economic growth continued to weigh on Greater Toronto Area (GTA) home sales in September. However, despite the market being better-supplied with listings, the average selling price was up year-over-year.

“The short and medium-term outlooks for the GTA housing market are very different. In the short term, the consensus view is that borrowing costs will remain elevated until mid-2024, after which they will start to trend lower. This suggests that we should start to see a marked uptick in demand for ownership housing in the second half of next year, as lower rates and record population growth spur an increase in buyers,” said TRREB President Paul Baron.

There were 4,642 home sales reported through TRREB’s MLS® System in September 2023 – down 7.1 per cent compared to September 2022. The year-over-year dip in sales was more pronounced for homes, particularly semi-detached houses, and townhouses. On a month-over-month seasonally adjusted basis, sales were also down slightly.

New listings were up strongly on a year-over-year basis from the extremely low level in September 2022. The number of listings also trended upward on a month-over-month basis.

“GTA home selling prices remain above the trough experienced early in the first quarter of 2023. However, we did experience a more balanced market in the summer and early fall, with listings increasing noticeably relative to sales. This suggests that some buyers may benefit from more negotiating power, at least in the short term. This could help offset the impact of high borrowing costs,” said TRREB Chief Market Analyst Jason Mercer.

In September, there were 16,258 new real estate listings — a 44 per cent increase compared to the same time last year, as the market continues to grapple with high interest rates, inflation, and uncertainty about the Bank of Canada’s next move on October 25th. The surge in new listings stems from investors in the condo market, but also from homeowners in low-rise houses who have “surrendered” to high interest rates.

Here are the top 5 trending stories of the week:

- Ontario Introduces Legislation To Change The Definition Of Affordable Housing “The Government of Ontario has introduced new legislation that would change the definition of affordable housing, enabling more units to be exempt from development charges. If the bill, dubbed the Affordable Homes and Good Jobs Act, is passed, the definition would include income as a measure of affordability..”

- Toronto’s vacant home tax set to rise after busting tons of investors hogging housing “It appears that based on recent figures, Toronto’s vacant home tax has been a huge success for the city, bringing in just as much as expected during its first year while other taxes have failed to do so in our tanking real estate market..”

- Opinion: Trudeau finally realizes housing affordability could cost him the next election “Preparing to purchase your first condo in Toronto can be an incredibly stressful experience (to say the very least), given all the uncertainties that come with the city’s real estate market through increased competition and rising costs. According to the Toronto Regional Real Estate Board (TRREB), the average one-bedroom condo apartment rent in Q2 2023 was a staggering $2,532, representing an 11.6 per cent increase from Q2 2022. “

- Bank of Canada hikes likely won’t continue into 2024: expert “The federal government is unlocking $20B in low-cost financing for the construction of rental apartments. The annual limit for the Canada Mortgage Bonds program is being increased from $40B to $60B, Chrystia Freeland, Deputy Prime Minister and the Minister of Finance, announced on Tuesday. The program generates funds for residential mortgage financing. The increase will unlock low-cost financing for multi-unit rental construction, and help to build up to 30,000 additional apartments per year across the country. It has no fiscal impact on the federal government, Freeland noted. “

- Is the worst over for Canadian real estate, or more trouble ahead? “Have Canadian housing markets been through the worst of it, or is there still further to fall? Well, it depends on where you’re looking. Regional variations have become increasingly apparent nationwide, as noted in a Sept. 29 report from Robert Kavcic, senior economist with the Bank of Montreal..”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.