MARKET INSIGHT FOR THE WEEK ENDING November 24th

In Canada’s housing market, it matters who your parents are. Children of homeowners twice as likely to own a home, finds Statistics Canada study.

Getting on the property ladder is so tough these days more young Canadians despair of ever getting to the first rung.

Prices have cooled since the pandemic housing boom, but higher mortgage rates are a new hurdle for would-be buyers.

A new study by Statistics Canada has found that some Canadians have an advantage for getting on that ladder over others — their parents.

The study, according to the agency, provides the first detailed analysis of the relationship between parents who own property and the likelihood of their children owning a home, using tax data and data from the Canadian Housing Statistics Program.

Statistics Canada’s novel database combines records from 3.4 million parents and 2.6 million of their kids born in the 1990s. The report is the first in a series investigating inter-generational housing outcomes in Canada.

It found that adult children born in the 1990s whose parents were homeowners were twice as likely to own a home than those whose parents were not homeowners.

Children of homeowners had a homeownership rate of 17.4 per cent, compared with a homeownership rate of 8.1 per cent for the children of parents who did not own a home.

The homeownership rate of children whose parents owned more than one property was even higher at 23.8 per cent, nearly triple the rate of the children of non-homeowners.

The study also found “significant differences” between the average income of the adult children who owned a home and those who did not. The average income of non-owners was $36,000, while homeowners had an average income of $65,000.

The average income of adult children with parents who owned multiple properties was about $6,000 higher than those of non-homeowners.

Where you live also makes a difference. Canadians born in the 1990s had the highest rates of homeownership in New Brunswick at 20.5 per cent and the lowest in British Columbia at 14.1 per cent, reflecting that region’s high property price.

The gain from parental property ownership to the homeownership rate was also highest in Ontario and British Columbia.

“This may signal that in housing markets with higher property values, where higher incomes are necessary for ownership, parents’ property ownership or wealth plays a larger role in their adult children’s homeownership outcomes,” said the study.

Growing unaffordability of housing in Canada has increased younger generations’ reliance on the so-called bank of mom and dad.

Statistics Canada cites a CIBC study that showed between 2015 and 2021, the share of first-time buyers who received a financial gift from family rose from 20 per cent to 28 per cent, and the average amount of the gift rose from $50,000 to $80,000.

Here are the top 5 trending stories of the week:

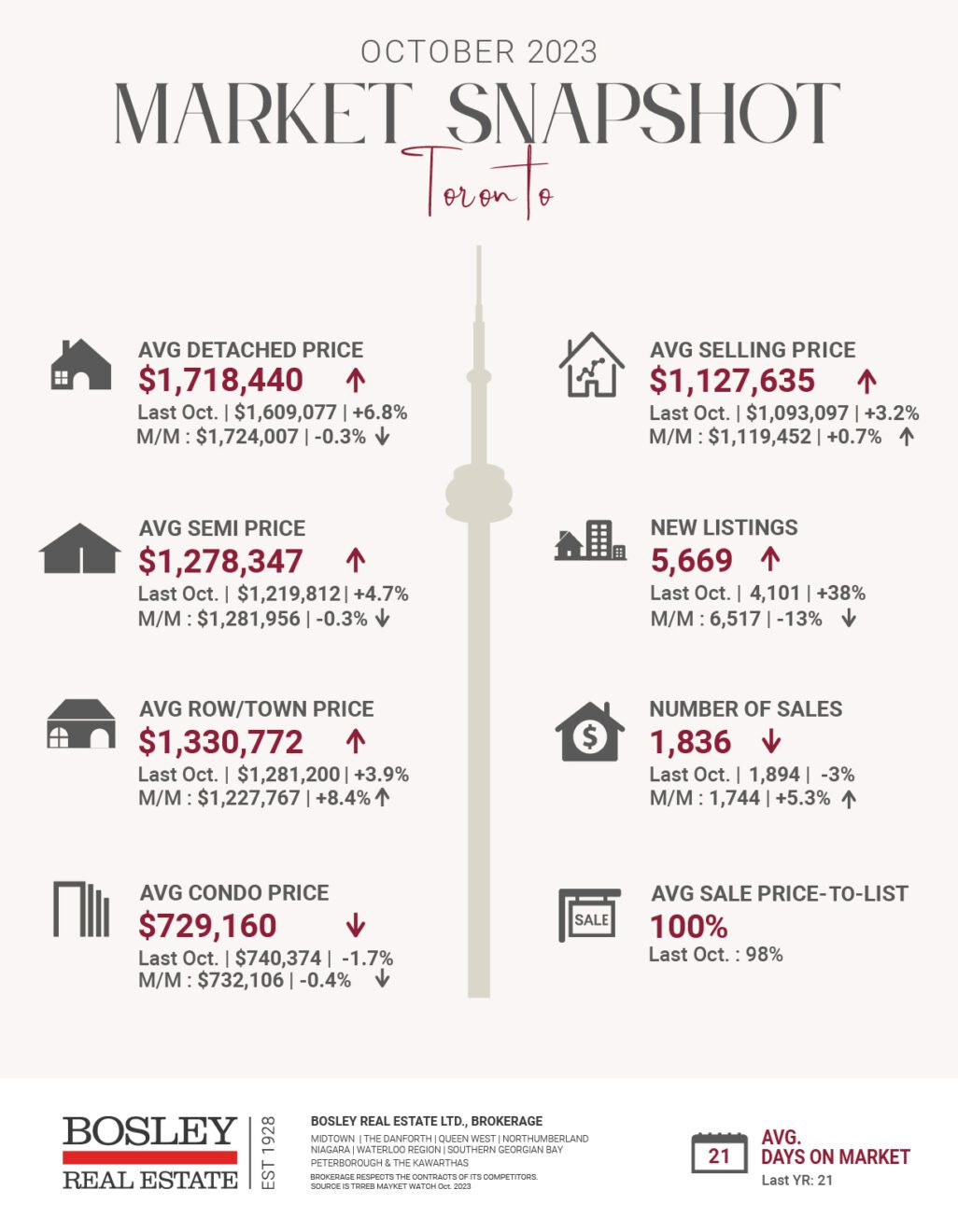

- Canadians feeling the strain as weak sales persist | “It seems that the interest rate reality is finally catching up to the Canadian housing market, with very few positive data points to report when it comes to home sales in October 2023, as the Canadian Real Estate Association reports..”

- “It’s A Trillion-Dollar Problem”: Feds’ New Housing Funding Not Enough To Help Affordability, Experts Say | “The federal government appears to be making a concerted effort to address Canada’s chronic housing shortage and ever-worsening affordability issues. The feds’ fall economic statement, presented on Tuesday by Finance Minister Chrystia Freeland, includes a heap of housing-focused measures intended to boost rental supply and ease Canadians’ financial strain. Highlights include $15B towards loans for new rental buildings, $1B for the construction of affordable housing, and $309.3M for the development of co-operative housing.”

- Canadian Interest Rates 2 Points Higher Due To Gov Spending: Scotiabank | “Canadian policymakers have been spending like drunken sailors, and it’s going to cost households. Not just in the form of taxes and service reductions, but on their mortgage too. A new analysis from Scotiabank looked at just how much government spending drove inflation, and thus interest rates. They estimate the Bank of Canada (BoC) overnight rate is a whopping 2 points higher due to the spending, primarily driven by the provinces. “

- Influx of seniors who stay in family home face ballooning borrowing costs: Dale Jackson “A new report from the Canada Mortgage and Housing Corporation (CMHC) finds more seniors are choosing to age in their homes longer before downsizing or renting. Those who tap into the equity in those homes to meet day-to-day living expenses might not fully realize how the recent spike in borrowing costs will eat away at their nest-eggs much faster.”

- Have you seen these flyers? Real estate broker explains ‘cash for home’ offers “Amid Canada’s crushing housing supply shortage, some homeowners may have noticed a rise in flyers offering to pay cash upfront(opens in a new tab) for property. One real estate broker explains that although these mysterious notes are legal, it’s usually a strategy from investors looking to make a quick profit.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.