Ontario home sales are expected to jump by almost 10 per cent next year.

Ontario home sales are projected to rise by nearly 10% in 2025, driven by pent-up demand from buyers awaiting further interest rate cuts. This could lead to significant momentum starting in the spring or summer of next year.

The Canadian Real Estate Association (CREA) forecasts a more stable real estate market in 2025 following a slow 2023 and 2024.

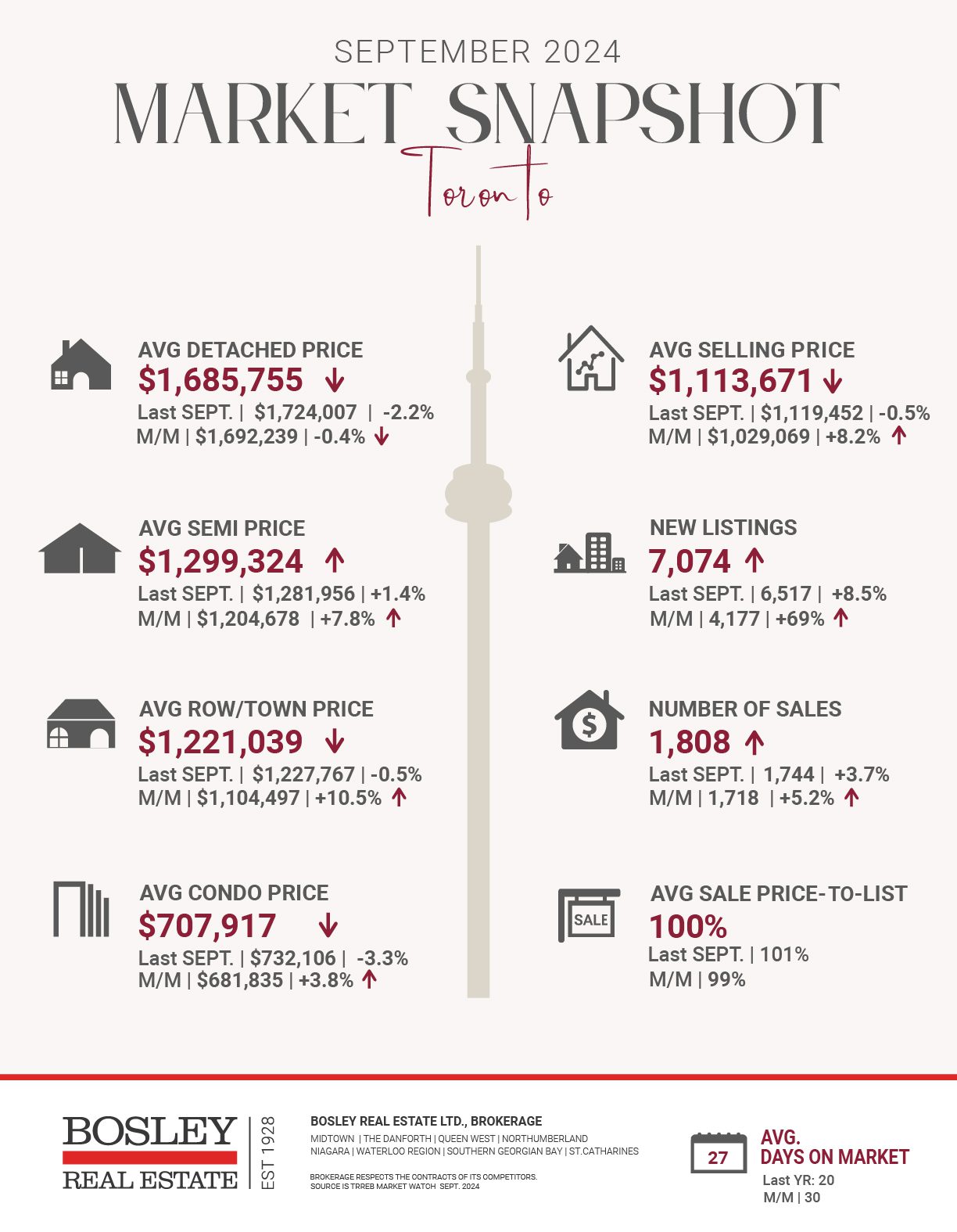

Ontario’s annual sales declined by over 12.3% in 2023, followed by a slight 1.5% increase this year. With a 9.9% sales jump anticipated in 2025, the market is expected to return to levels seen in previous years. Home prices are also expected to grow modestly by 2.4%.

The Bank of Canada cut its key interest rate by 0.25 percentage points in June, July, and September, lowering the rate from 5% to 4.25%. Economists are predicting an additional 0.5% reduction when the next rate announcement is made on October 23rd.

However, CREA revised its housing market forecast for the remainder of this year, noting that the interest rate cuts haven’t sparked the gradual recovery initially expected.

“Sales have increased for three consecutive months following the interest rate cuts, showing a trend, though not a dramatic one,” said Shaun Cathcart, CREA’s senior economist.

With the pace of rate cuts now expected to be much faster than previously thought, it’s possible some buyers may choose to hold off on a purchase for now. This could further boost the rebound expected in 2025 at the expense of the last few months of this year.

In early September, a surge in new listings provided buyers with more choices before the market typically slows down for the balance of the year.

While some buyers may choose to take advantage, others may be inclined to wait, as more substantial rate cuts from the Bank of Canada are now expected to show up in a matter of months as opposed to years. That being said prices will rise with more interest rate cuts and we could see an active and vibrant spring market on the horizon.

Here are the top 5 trending stories of the week:

- Expert predicts massive interest rate cut from Bank of Canada next week | “Earlier this week, Statistics Canada reported that the country’s inflation rate had dropped to 1.6%, much lower than the BoC’s target of 2%. This only strengthens existing speculation that a slew of rate cuts is coming soon.”

- TD economist predicts ‘sizeable’ bump in housing market activity this quarter | “An economist with TD Bank says he expects to see a significant increase in housing market activity from now until the end of the year as more buyers come off the sidelines in the wake of interest rate cuts by the Bank of Canada. In an interview with BNN Bloomberg on Wednesday, Rishi Sondhi said that he expects homebuyers to jump back into the market in big numbers in the fourth quarter as lower rates improve affordability nationwide.”

- Canadian Real Estate Market Forecast for 2024 and 2025 | “The Canadian real estate market has been on a rollercoaster ride lately. Interest rate hikes have cooled things down significantly, but there’s light at the end of the tunnel. The Canadian Real Estate Association (CREA), a highly reputable source, recently adjusted its forecast, and it paints a pretty interesting picture. We’ll unpack that forecast in detail, but the big takeaway is that while we’re not seeing a boom, neither are we in a freefall. It’s a more nuanced situation than the headlines might suggest. This forecast depends heavily on what happens with interest rates. ”

- High interest rates blamed for massive decline in Canadian new home construction | “In a new bulletin, Canada Mortgage and Housing Corporation (CMHC) estimates higher interest rates decreased new home construction by about 30,000 units in 2023, which is roughly equivalent to a drop of 10 per cent to 15 per cent of the annual total that would otherwise be expected — based on the annual average of about 250,000 units.”

- Roommate Rental Listings Up Nearly 50% Across Major Canadian Markets | “Major rental markets across the country are cooling, but that doesn’t mean that affordability has improved. In fact, a new report from Rentals.ca and Urbanation shows that roommate accommodations are becoming increasingly common as property owners attempt to cash in on rental revenue. Taking into account four major Canadian provinces — British Columbia, Alberta, Ontario, and Quebec — the data reveals that listings for shared accommodations have shot up a few hairs shy of 50% over the past year (48.7%, to be exact). ”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.