MARKET INSIGHT FOR THE WEEK ENDING – May 5th, 2023

Competition Is Heating Up in the GTA Real Estate Market as Prices Pick Back Up

With the spring market in full swing, competition for real estate in the Greater Toronto Area (GTA) is heating up as a consistently low number of listings leaves would-be buyers with few options.

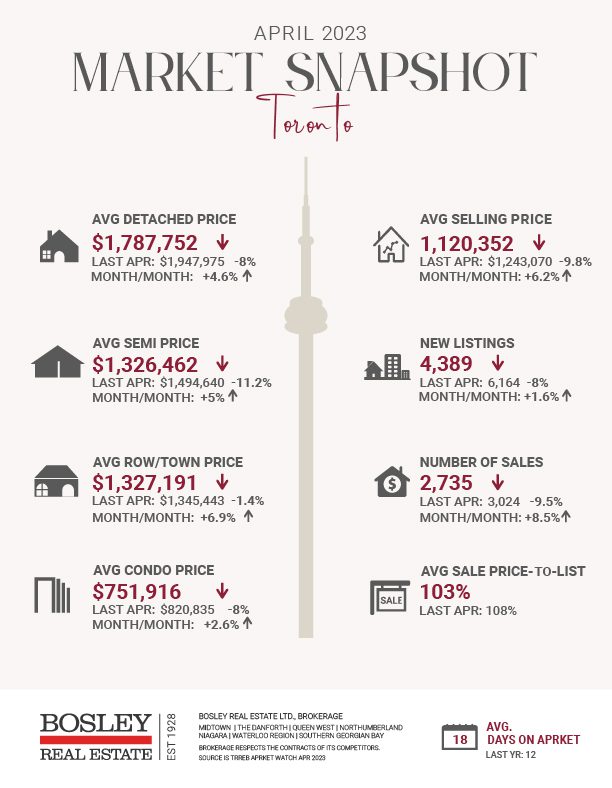

Sales were on the up and up in April, reaching 7,531, according to new data from the Toronto Real Estate Board (TRREB). This marks a rather significant 9.2% jump from March sales but, notably, is a 5.2% drop from the sales seen in April of last year. At the same time, the number of new listings in the GTA has remained relatively flat, far from keeping pace with the jump in sales. With a grand total of 11,364 new listings in April, this marks a 1.6% increase over March and a 38.3% decline on an annual basis.

“Many buyers have come to terms with higher borrowing costs and are taking advantage of lower selling prices compared to this time last year,” said TRREB President Paul Baron. “The issue moving forward will not be the demand for ownership housing, but rather the ability to meet this demand with adequate supply. This is a policy issue that requires a sustained effort from all levels of government.”

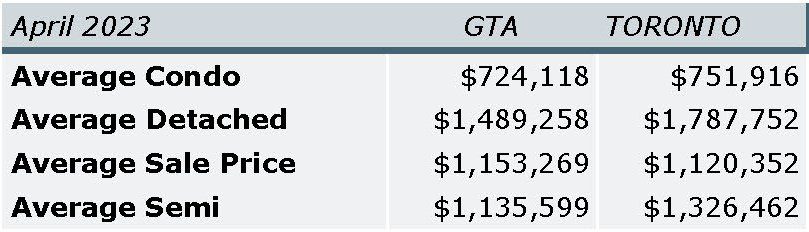

Those lower selling prices, however, are changing. With fewer listings and more buyers, market conditions are unsurprisingly tight, helping to push prices up. The average selling price in April all across the GTA hit $1,153,269 — a slight, but not negligible, 4% increase from just one month prior

Price increases were seen across all housing types, but the biggest change was found in townhomes, where a 5.5% month-over-month increase brought the new average price to $986,121. It was followed by semi-detached homes with a 4.4% jump to $1,135,599, condos with a 2.8% jump to $724,118, and detached homes with a 1.4% jump to $1,489,258.

“As demand for ownership housing has picked up relative to supply, we are seeing renewed upward pressure on home prices. For a short period of time, higher borrowing costs trumped the impact of the constrained housing supply in the GTA. Renewed competition between buyers is once again shining the spotlight on the persistent lack of listings and resulting impact on affordability,” said TRREB Chief Market Analyst Jason Mercer.

Here are the top 5 trending stories of the week:

- Canadian Real Estate Prices Set To Rip Higher After BOC Signal: BMO “Canada’s real estate correction may already be over, as prices return to sharp growth. BMO Capital Markets wrote to investors this week to explain they see higher home prices in the near-term. The bank observed that shortly after the Bank of Canada (BoC) warned of no further rate hikes, buyers returned with bigger budgets and new inventory suddenly dried up. Now the most powerful price indicator is pointing to a sharp increase for home prices in the next few months.”

- ‘Excruciatingly Long Delays’ Up to Two Years at Landlord and Tenant Board “Ontario’s landlords and renters alike are facing “excruciatingly long delays” at the Landlord and Tenant Board (LTB), sometimes up to two years, as the backlog of cases has now grown to a staggering 38,000. This is according to a new report from Ombudsman Paul Dubé, released on Thursday, detailing issues with the frustratingly slow-moving LTB, as well as a list of recommendations to fix them..”

- Here’s how long you need to save up to buy a condo in Toronto “Buying your first condo can be a stressful experience, given all the ups and downs of Toronto’s real estate market. Instead of grappling with the city’s soaring rent prices, you also might be tempted to invest in the long haul and save up to purchase your own condo apartment instead.”

- This Week’s Top Stories: Canadian Mortgages Over 35 Years Soar, & Money Supply Slows “Canada’s Big Six banks have a significant share of mortgages with amortizations over 35 years. BMO, CIBC, TD, and RBC all reported over a quarter of their portfolio had amortizations over 30 years. The strategy might be used to avoid negative amortizations when payments fail to cover interest. It’s not a widespread banking issue as two of the Big Six did not report any significant change in the share of mortgages with long amortizations.”

- Website created by two Ontario residents helps tenants rate their landlords “Ever had to live with mice, mould or roaches thanks to a lousy landlord? Renters in Canada have to deal with some ridiculous things, but a new website might be about to shake things up in the Canadian rental market. Rate The Landlord is a review website that was created by two Ontarians to help improve landlord accountability.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.