The real estate price correction appears to be over in Canada after a yearlong slump that saw prices drop by almost 18% in Toronto, according to a new report from RBC.

The spring market was a turning point for the country’s housing market as April home resales spurted 11.3% month over month nationwide, marking the strongest monthly advance in almost three years, the report said.

Prices rose in back-to-back months for the first time since early 2022 — before the Bank of Canada’s aggressive rate hikes — and demand-supply conditions suddenly appear tight.

“Resurging demand and low inventories have put sellers back in the driver’s seat in most major markets, including Toronto, Vancouver, Calgary and Halifax,” said Robert Hogue, senior economist at RBC.

While activity is still running at 11% less than just before the pandemic, that may not last for long if more sellers enter the market. New listings have significantly lagged behind resales, but if prices continue upward sellers might be more inclined to jump back into the market, Hogue said.

Rising prices could spur more sellers into action. We suspect many have been waiting out the correction until conditions turned in their favour. A rise in supply would help unlock more of the pent-up demand that built over the past year.

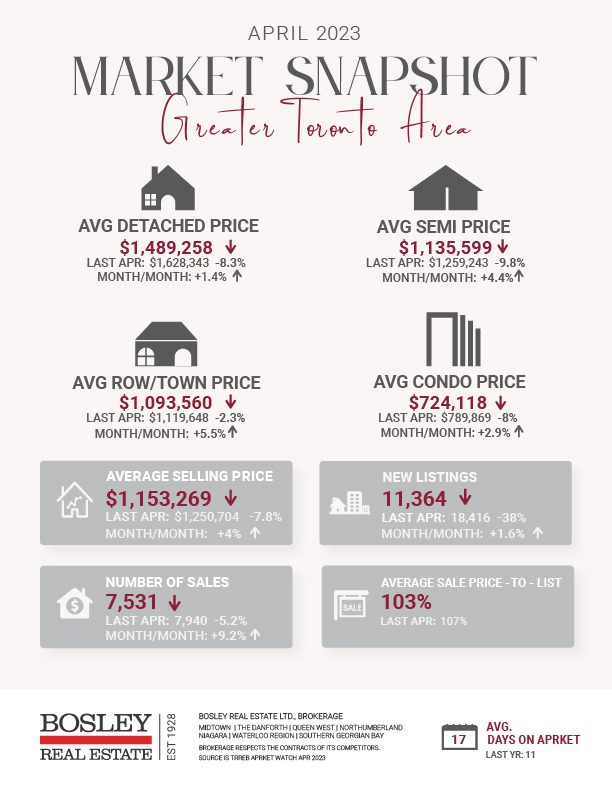

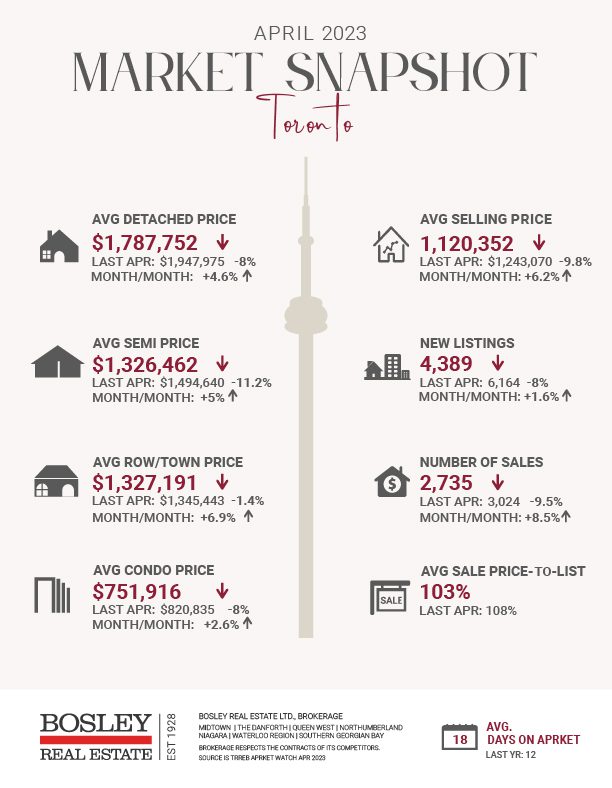

According to the Toronto Regional Real Estate Board, the average home price in Toronto rose to $1.15 million in April from $1.03 million in January (when prices likely bottomed out in Toronto) or almost a 10% increase.

On the ground, there is a frenzy of activity in downtown Toronto as homes receive multiple offers and are spending less time on the market.

The spring market comeback is a surprise for Hogue, who originally forecast a claw back for real estate prices and sales once prices bottomed out in the summer.

But there are still various factors at play that could cool the market again. The Bank of Canada has paused rate hikes, but more could be announced if inflation doesn’t continue to go down. Inflation rose to 4.4% in April from 4.3 per cent in March, the bank announced on Tuesday.

And more inventory could enter the market with the provincial government’s push to create more housing, along with the record number of condo new builds coming to the market.

Expectations of further interest rate hikes with an expected increase of supply in Toronto may cool off prices and activity again. Yet, affordability remains a top concern in Toronto as building new housing takes time.

Here are the top 5 trending stories of the week:

- Canada’s Rapidly Rebounding Real Estate Market Is Bad News For BoC “Up 11.3% on a monthly basis, it marks the third, and largest, consecutive monthly increase in sales. Meanwhile, listings rose just 1.6% in April following back-to-back months of decline. The tightening market conditions — the sales-to-new-listings ratio rose to 70.2% — pushed the MLS Home Price Index (HPI) up 1.6%, the second straight monthly increase after nearly a year of drops.”

- Average Canadian house price rose to $716,000 in April — up by $100K since January “The Canadian Real Estate Association said Monday that the average selling price of a home that sold on its MLS system in April went for $716,000. That’s the fourth monthly increase in a row, and it marks a collective increase of more than $100,000 since the start of the year.”

- Canada’s housing market shifts into sellers’ conditions “Under the existing bylaw, Toronto requires that any developer planning to demolish rental buildings with six or more units must replace the existing units with ones of comparable size and price and offer those to existing tenants. They must also provide comparable alternative housing for any necessary relocation, and compensation for additional costs relating to relocation.”

- Average Toronto rent prices just skyrocketed by a shocking amount “Toronto’s rent prices continued their meteoric ascent in April, and it will now cost you a shocking average of $2,822 to rent a home in Canada’s economic heart. According to the latest National Rent Report from Rentals.ca and Urbanation, the Toronto area’s average rental prices increased by an alarming 41 per cent in April compared with the pandemic low recorded two years earlier.”

- More B.C. tenants are evicted through no fault of their own than anywhere else in Canada, report says “Renters in British Columbia face the highest eviction rates in Canada, but it’s through no fault of their own, according to a new report from researchers at the University of British Columbia. UBC’s Housing Research Collaborative found that B.C. continues to have the highest eviction rate in the country. Between 2016 and 2021, 10.5 per cent of renter households in B.C. reported being forced to move by their landlord, nearly double the 5.9 per cent national average. “

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.