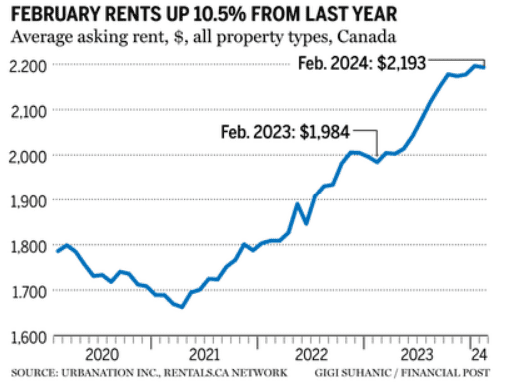

A new report released this week says the average asking price for a rental unit in Canada was $2,193 per month in February, up 10.5% year-over-year and the fastest annual growth since September 2023.

The data released Monday by Rentals.ca and Urbanation, which analyzes monthly listings shows the average monthly cost of a one-bedroom unit in February was $1,920, up 12.9% from the same month in 2023. The average asking price for a two-bedroom was $2,293, up 11.3% annually.

The report says rents in Canada have increased overall by a total of 21% or an average of $384 per month, from two years ago, just before the start of interest rate hikes by the Bank of Canada.

Alberta maintained its status as the province with the fastest-growing rents, with total average asking prices up 20% annually last month to reach $1,708. British Columbia and Ontario posted the slowest growth in February, with annual increases of 1.3% and 1%, respectively. But the provinces remain Canada’s most expensive for renters, with total average asking rents of $2,481 in B.C. and $2,431 in Ontario.

It appears that traditional purpose-built rental apartments experienced the fastest year-over-year price growth in February, with a substantial increase of 14.4%, averaging $2,110 in rent. Meanwhile, condominium rentals and apartments in houses saw slower annual growth rates of 5% and 5.3%, respectively, with average rents of $2,372 and $2,347.

Additionally, there was a notable surge in roommate listings last month. The number of listings for shared accommodations in Canada’s four largest provinces increased by 72% in February compared to the previous year. The average rent for shared accommodations also rose, with a 12% increase to $1,010.

Breaking down the data by province, British Columbia saw a 13% annual growth in roommate rents to $1,186, Alberta experienced a 12% increase to $873, Ontario witnessed a 9% rise to $1,099, and Quebec observed a 5% uptick to $920 in average roommate rents.

Here are the top 5 trending stories of the week:

- These Canadian cities are selling property for as low as $1 to get you to move there | “The dream for aspiring homeowners may look like scoring $1 worth of land amid rising housing prices and inflation. The good news is that this dream has come true in some Canadian provinces and territories, which have offered eye-catching relocation incentives to address population decline, housing crises and affordability.”

- Look for measures to make housing more affordable in federal budget | “Canada’s housing affordability crisis is expected to be one of the main focuses of the budget when it is tabled on April 16 and Canadians can expect more affordability measures, said Tal, deputy chief economist at CIBC Capital Markets.”

- Leading By Example: ‘Missing-Middle’ Pilot Project Moves Forward In The Beaches | “Say you want to buy a home in Toronto and have a budget of $600,000. You also want three bathrooms. At the end of January, 236 homes for sale fit that description on realtor.ca. Settle for two bathrooms and your options triple: 724 possible matches. And if you can get by with one, your options would double again to 1,565, or nearly five times the original number of potential homes.”

- Land for $10? This Canadian town might be the answer to your homeownership dreams | “The Bank of Canada has held its key interest rate at five per cent again, saying that it’s still too soon to consider rate cuts while underlying inflation persists.”

- Not everyone is happy about Toronto’s plan to redevelop hundreds of parking lots | “Toronto may be making progress on building more desperately-needed housing, but the city has still got a way’s to go if it wants to meet the demand of a too-rapidly growing population and recover any semblance of affordability.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.