Just as Canada’s housing market was starting to rebound, the Bank of Canada has dealt it another blow. The bank’s decision to raise its key interest rate 25 basis points to 4.75 per cent on June 7 could put downward pressure on home prices, which have rebounded faster than the bank had expected. This latest interest rate hike could add to the financial burden of some variable mortgage holders and those renewing fixed rate loans this year.

The rise brings the policy rate to the highest it’s been since April 2001.

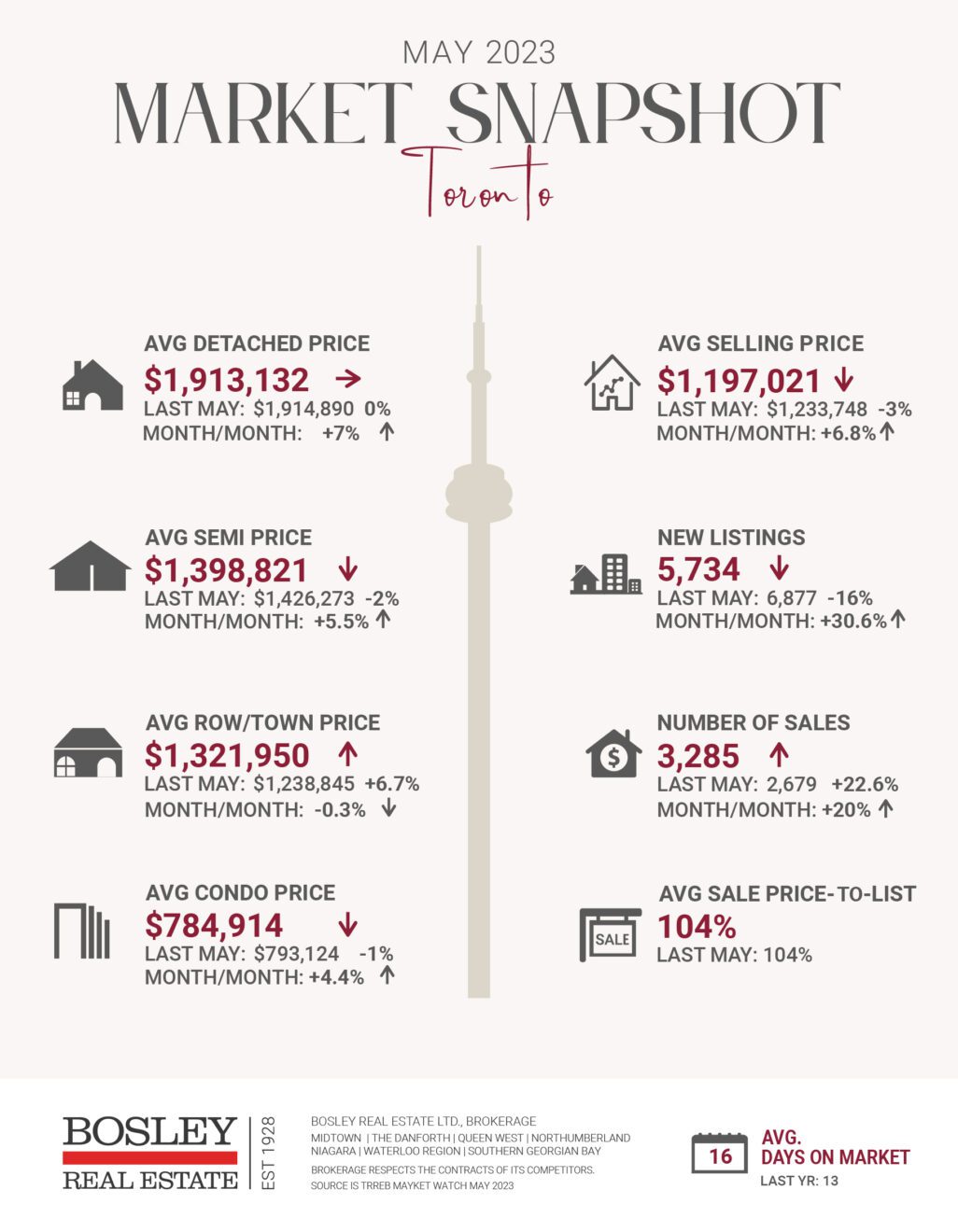

May was the fourth consecutive month in which the average selling price of a home rose in the GTA up to nearly $1.2 million, only 1.2 per cent behind the same month last year.

Benchmark home prices in Toronto increased 3.2 per cent in May to $1.14 million on a seasonally adjusted basis, the biggest increase since the market peaked in February 2022, according to the Toronto Regional Real Estate Board.

Meanwhile in Vancouver, the Real Estate Board of Greater Vancouver said May home sales rose 15.7 per cent from a year earlier, while prices increased for the sixth consecutive month, showing signs of heating up heading into the summer.

Rising rates have an oversized psychological impact on people buying and selling properties in this country, and so it might create a small stall in the market. They say that the lack of homes listed for sale in the Toronto area will continue to buoy prices for the foreseeable future.

Home buyers have adjusted to the higher rates of the last year and aren’t likely to step back again because of an additional quarter-point on their mortgage. Even before the first of the last nine rate rises, the mortgage stress test required home buyers to qualify for a loan at a higher rate than their bank actually charges.

People assume buyers will be immediately impacted by a rate rise, but anybody who is actively in the market has a pre-approval locked in.

There will be pain in some quarters, however, said Ron Butler of Butler Mortgage. Some variable mortgage holders will hit the trigger where the interest portion of their loan surpasses the total mortgage payment, often pushing them into longer

amortization periods.

For those with fixed rate loans renewing this year, Wednesday’s interest rate increase “is a real blow,” because, after falling March through May, those rates have been rising again and the central bank’s announcement means all chances of rate cuts this year have vanished, he said.

“Some of the better options in the 4 per cent range that existed just three or four weeks ago are gone. It’s going to be nothing but rates that start with a five or possibly even rates that start with a six,” said Butler.

Here are the top 5 trending stories of the week:

- The Bank of Canada Increased the Overnight Rate to 4.75 Per Cent “Canadian housing markets could spell trouble for the economy overall. Despite housing sales increasing by 11.3 per cent in April, Canadian housing prices have declined April year-over-year by 3.9 per cent. At the core of this are interest rates which have continued to sour the notion of housing affordability as mortgage holders have to pay more to service their debt. “

- Ontario is lacking condo managers and some worry it’ll only get worse as more units get built “According to data from the province and the industry’s separate regulatory body, The Condominium Management Regulatory Authority of Ontario (CMRAO), there are currently some 2,500 licensed managers in the province overseeing around 950,000 units across Ontario. ”

- Total Value Of Building Permits Falls To Lowest Level Since December 2020 “After a record-high March, non-residential construction intentions slowed in April, bringing the total value of building permits issued across Canada to their lowest level in more than two years.”

- The amount that investors have been making and losing on Toronto condos may shock you “Some interesting new data on Toronto’s condo market is shedding light on how speculative real estate investment in the city may be in for a change, as rising new condo prices paired with higher interest rates may scare some away from what used to be perceived as a sure moneymaker.”

- The tallest condo in Canada is coming to Ontario but it’s not in Toronto ” A new skyscraper currently in the works for Southern Ontario is slated to become the tallest condo building in the entire country if developers manage to make it happen as planned. The striking 77-storey, 224-metre-high tower will house a staggering 962 residential units and would become the loftiest building in its city if completed fast enough, reshaping the skyline as we know it and providing stunning 360-degree views of the area.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.