MARKET INSIGHT FOR THE WEEK ENDING June 30th , 2023

Olivia Chow Is Now Mayor of Toronto. Here’s How She Plans To ‘Fix’ Housing.

Olivia Chow was elected Mayor of Toronto during Monday’s by-election. And now the conversation shifts to what she will do to solve some of the chronic housing problems facing Toronto — and mind you, that will be without the help of strong mayor powers, which Chow has maintained she will not be utilizing during her term.

Greater Advocacy for Renters – Chow has laid out a number of renter-centric goals over the course of her campaign. One of her earlier promises was that she will establish a Renters Action Committee composed of City staff, renters, housing providers, and advocates. This dedicated task force would create anti-renoviction bylaws, advocate for real rent control, and review existing policies and programs related to renters.

She also seems to be all for bringing back rent control in Toronto — which, of course, isn’t under her jurisdiction, but she has said she will do her part in ‘urging’ the Ontario government to institute real rent control for all rental units.

Upping The Vacant Home Tax – One of Chow’s more controversial initiatives will be to raise the Vacant Home Tax to 3%. She intends to use those funds to support the City’s existing affordable housing initiatives, including rent supplements.

Also, on the topic of the Vacant Home Tax, Chow has spoken about combating some of the confusion surrounding the tax — particularly as it pertains to non- English speaking residents — with the use of public education facilitators and the creation of an information hotline.

Chow has additionally proposed raising the Municipal Land Transfer Tax on luxury homes, with new graduated rates on purchases of homes valued at $3 million and over. Those funds, garnered from less than 2% of home sales each year, will go towards supporting those experiencing homelessness.

Affordable Housing On City-Owned Land – As Toronto continues to grapple with a worsening housing crisis, Chow has vowed to build 25,000 rent-controlled homes over the next eight years on City-owned land. This is a move that would see the City act as the developer, taking the onus off of the private sector.

Of those 25,000 units, at least 7,500 would be affordable units and at least 2,500 would be rent-geared-to-income. To that end, she will streamline and simplify the approval process — and more specifically, that she hopes to “batch up” applications to get them off the ground more efficiently. This plan, she has said, will complement the City’s existing housing programs and initiatives, including Housing Now and the recently approved multiplex allowances.

Chow has also said that she is all for building up density on main streets and along transit routes, saying that building up affordable and dense housing near the

transit corridor helps city residents while also cutting down on parking requirements and supporting TTC ridership.

Strengthened Homelessness Supports – Toronto’s growing homeless population — and the unsafe conditions they face living on the streets — is not lost on Chow, who has said she will strengthen the City’s approach to supporting people struggling with homelessness and keeping people housed.

More specifically, Chow plans to create 1,000 new rent supplements to help people secure permanent housing, open new 24/7 respite spaces, and establish a new fund for services, which will be under the scope of community agencies, front-line workers, and people who have experienced homelessness themselves.

Finally Property Taxes – Chow has refused to provide a number for how much she would raise taxes, saying only that any increase would be “modest.”

Chow said that no one can predict what interest or inflation rates will be by the start of the 2024 budget process, or what type of down payment the city might require on priorities like her affordable housing plan. “So, all of that combined is what leads me to being straight up and honest and saying, I can’t tell you precisely what percentage it’s going to be,” she said.

Chow said the city’s $1.5 billion operating shortfall is too large to address through property taxes alone, so she has vowed to secure funding from other levels of government to help fill the gap.

Property taxes are expected to generate about $4.9 billion for the city this year, and account for about 30 per cent of the municipality’s $16.2 billion operating budget, the largest single source.

Here are the top 5 trending stories of the week:

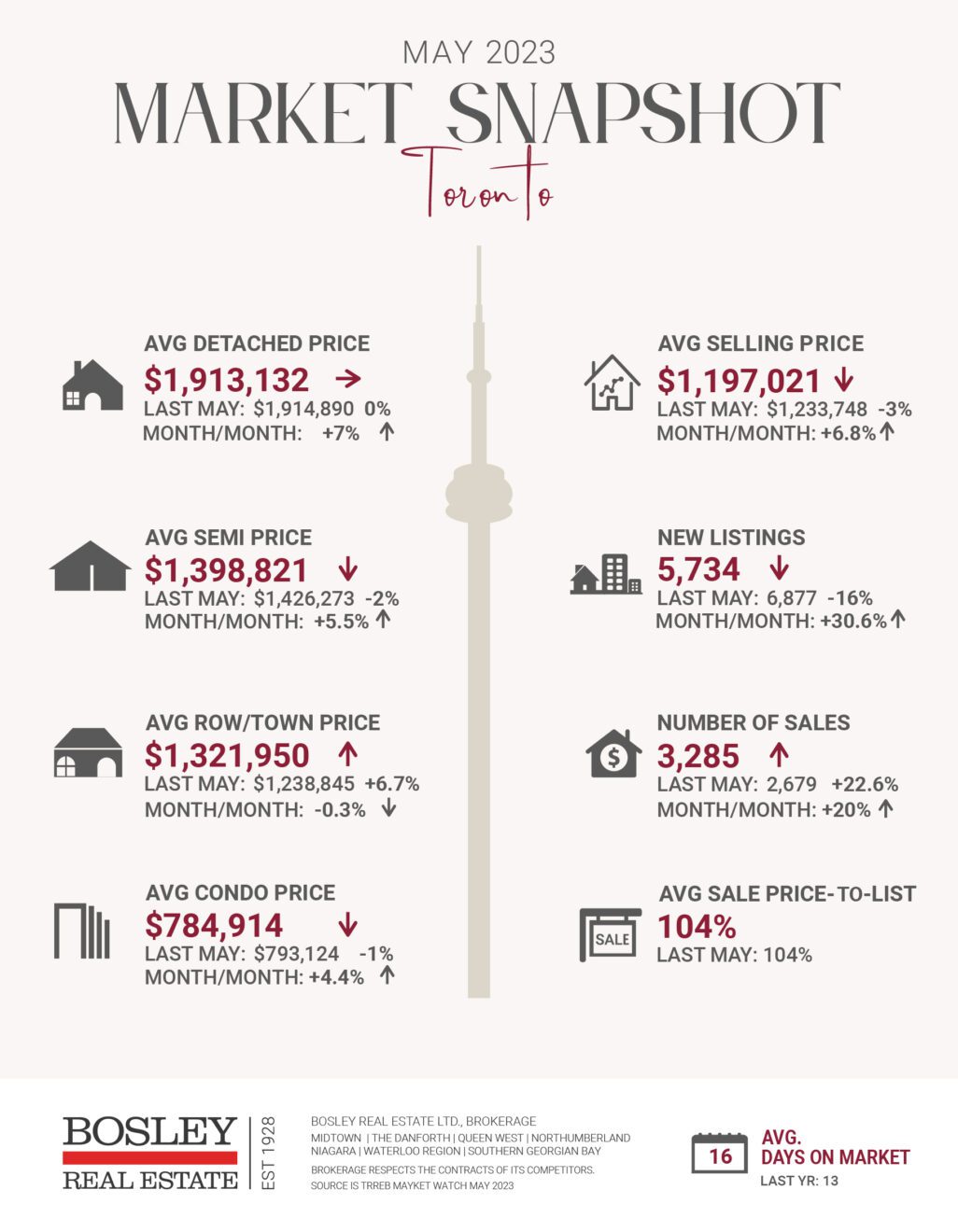

- GTA real estate market: Overbidding frenzy continues “Competition among homebuyers in the Greater Toronto Area (GTA) reached new heights last month as more neighbourhoods entered the realm of overbidding. According to a recent analysis by Wahi, 68 per cent of GTA neighbourhoods experienced overbidding in May, up from 57 per cent in April, reflecting a persistent upward trend throughout the year. “

- Housing Market Gains “Here To Stay,” Leading To Further Erosion Of Affordability “Following the correction that began in the spring of 2022, Canada’s housing markets have rebounded sharply over the last several months. The national average home price hit $729K in May, a monthly increase of $13K, and more than a $116K jump from January. Meanwhile, home sales have risen consistently month over month since February.”

- CIBC’s Tal on the impact of HST on rental housing “Waiving or deferring the harmonized sales tax (HST) on purpose-built rentals will be “the most pragmatic step” in keeping rents down, according to Benjamin Tal of CIBC Capital Markets. Postponing the payment of HST on purpose-built rental projects from first occupancy to the sale of the building, while keeping the same valuation, will be the “most realistic option” as its implementation will be relatively easy, Tal said.”

- NSAR makes sold prices public on Realtor.ca, a first in Canada “The Nova Scotia Association of Realtors (NSAR) has become the first province in the country to show the sold price of MLS listings on Realtor.ca. Matthew Dauphinee, president of NSAR, said the idea has been at the forefront for a while because of the demand from consumers for that extra layer of information.”

- Tiny home Toronto neighbourhood fought to stop now renting for $2450 “Toronto has entered into something of a laneway house renaissance as tiny homes populate backyards and laneway frontages across the city, but not everyone is happy about this new form of housing. A curious-looking new home tucked away in the backyard of 456 Armadale Avenue just hit the rental market, offering 0.5 bedrooms in what is essentially a glorified multi-level studio apartment measuring just 650 square feet and renting for $2,450 per month.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.