MARKET INSIGHT FOR THE WEEK ENDING June 16th , 2023

Toronto rents just skyrocketed again and here’s how much you’ll need to spend.

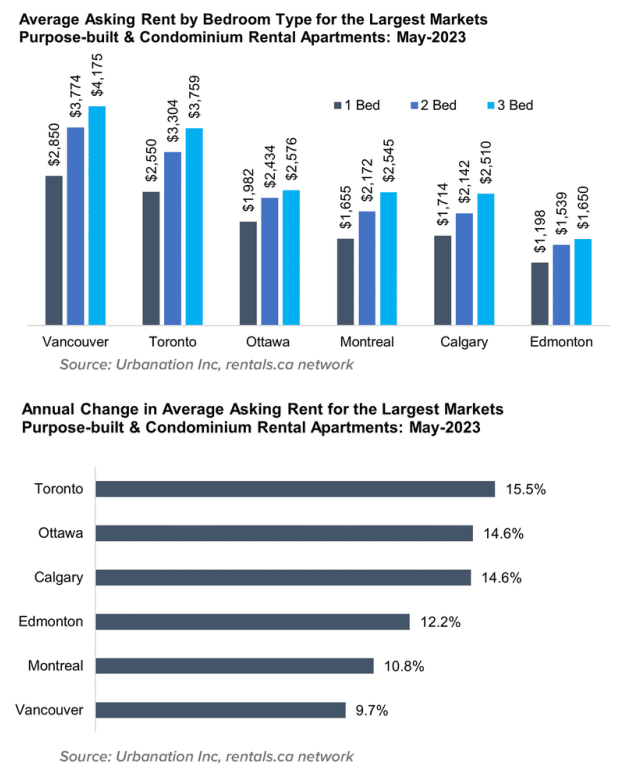

Toronto rents just skyrocketed again and here’s how much you’ll need to spend. It will now cost you well north of $2,800 to rent an apartment in Toronto, and renters looking to move into a new home will have to fork over more than 15% higher prices than this time last year.

The latest Rentals.ca and Urbanation National Rent Report shines a spotlight on rising rents across the country in May. Average rents rose by 6.5% nationwide last month, though that figure pales in comparison to the rate of rent price increases in the nation’s largest urban centre.

The City of Toronto ranked second on the list of 35 cities for average one-bedroom monthly rent in May, at $2,538, and third place for two-bedroom rent averages, at $3,286. That’s a 17.5% year-over-year spike in one-bedroom rents and a 12.4% increase for two-bedroom rents.

Overall rents in Toronto increased by 15.5% year-over-year in May to a new average of $2,808 for purpose-built and condominium rentals.

Prices have indeed experienced a surge in the last year, but when measured on a month-over-month basis, average rents decreased in Toronto last month.

The April average rent price clocked in at $2,822, meaning it’s a whole $14 more affordable to sign a lease than it was one month earlier.

Eight other Greater Toronto Area cities and areas were on the list, including Mississauga, Vaughan, Burlington, Etobicoke, North York, Scarborough, Brampton, Oshawa, Oakville, and Richmond Hill.

“Higher rents are on the horizon with interest rates at a 22-year high, rising home prices, and record immigration,” said Matt Danison, CEO of Rentals.ca Network.

“Gen Z could become the ‘Boomerang Generation’ moving back in with the parents or the ‘Roommate Generation’ splitting rent as it’s unaffordable for many Canadians to pay rent on their own,” says Danison, adding that “governments at all levels need to come up with creative solutions to increase housing supply.”

Here are the top 5 trending stories of the week:

- Majority of Canadians inclined to extend stay in current homes: CIBC poll “Homeownership remains a top goal for 71 per cent of non-homeowners, while the majority of mortgage holders (82 per cent) and renters (64 per cent) express concerns about inflation and rising rates affecting their ability to meet mortgage payments or rental costs. “

- Canada’s population set to reach 40 million on Friday: StatCan ” Canada will hit a milestone on Friday as it reaches a population of 40 million, according to Statistics Canada.The agency’s Population Clock, which models population growth in real time based on a number of factors (including recent trends for births, deaths and migration data), will strike 40 million just before 3 p.m. (EDT). “

- Philip Cross: Statistics Canada feeding misperception Canadians on the brink of financial ruin “Earlier this year, a Statistics Canada survey reported 26 per cent of Canadian households said they wouldn’t be able to cover an unexpected bill of $500 if one came along. With prices and interest rates higher now than they were then, that share may even have risen.”

- AI Entering Canadian Real Estate Market Via Wahi “One of the few industries moving at a faster pace than development is the tech sector, which has been particularly focussed, lately, on the deployment of Artificial Intelligence across the professional world. Already, digital entities with the ability to learn and communicate can draft emails, write songs in the voice of dead or living musicians, and instantly generate lifelike images based on a few basic prompts; now, thanks to online real estate platform Wahi, AI has made its entrance into the real estate space. “

- The Canadian Cities With The Highest And Lowest Property Tax Rates “Canada’s rapidly rising home prices are a widely discussed topic, but the costs incurred after you’ve purchased a property are an often overlooked aspect of affordability. Once you’ve made your down payment and secured a mortgage, homeownership costs, like property taxes, can be an afterthought. But they can cost upwards of $10K in some cities, resulting in an unpleasant surprise for cash-strapped buyers.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.