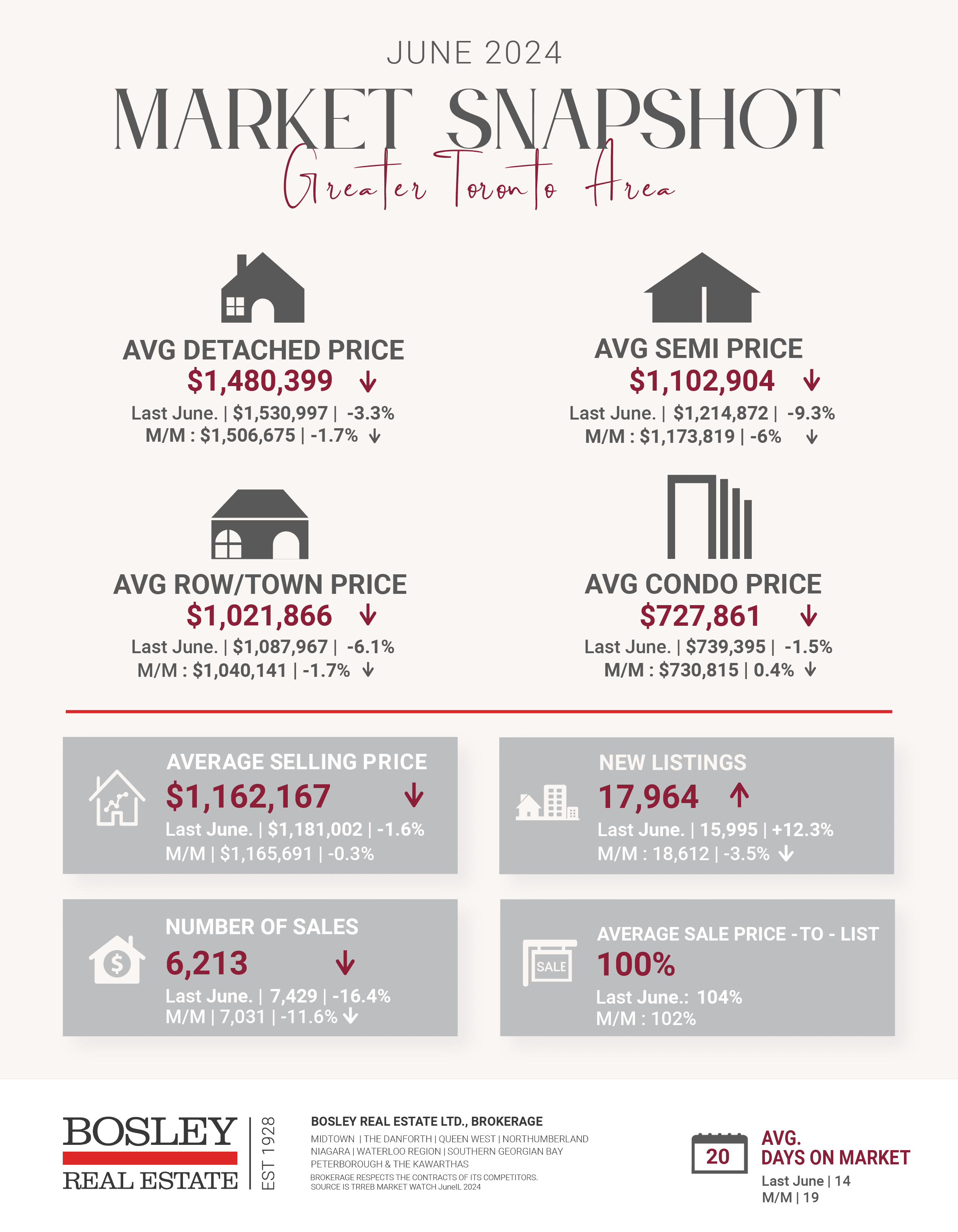

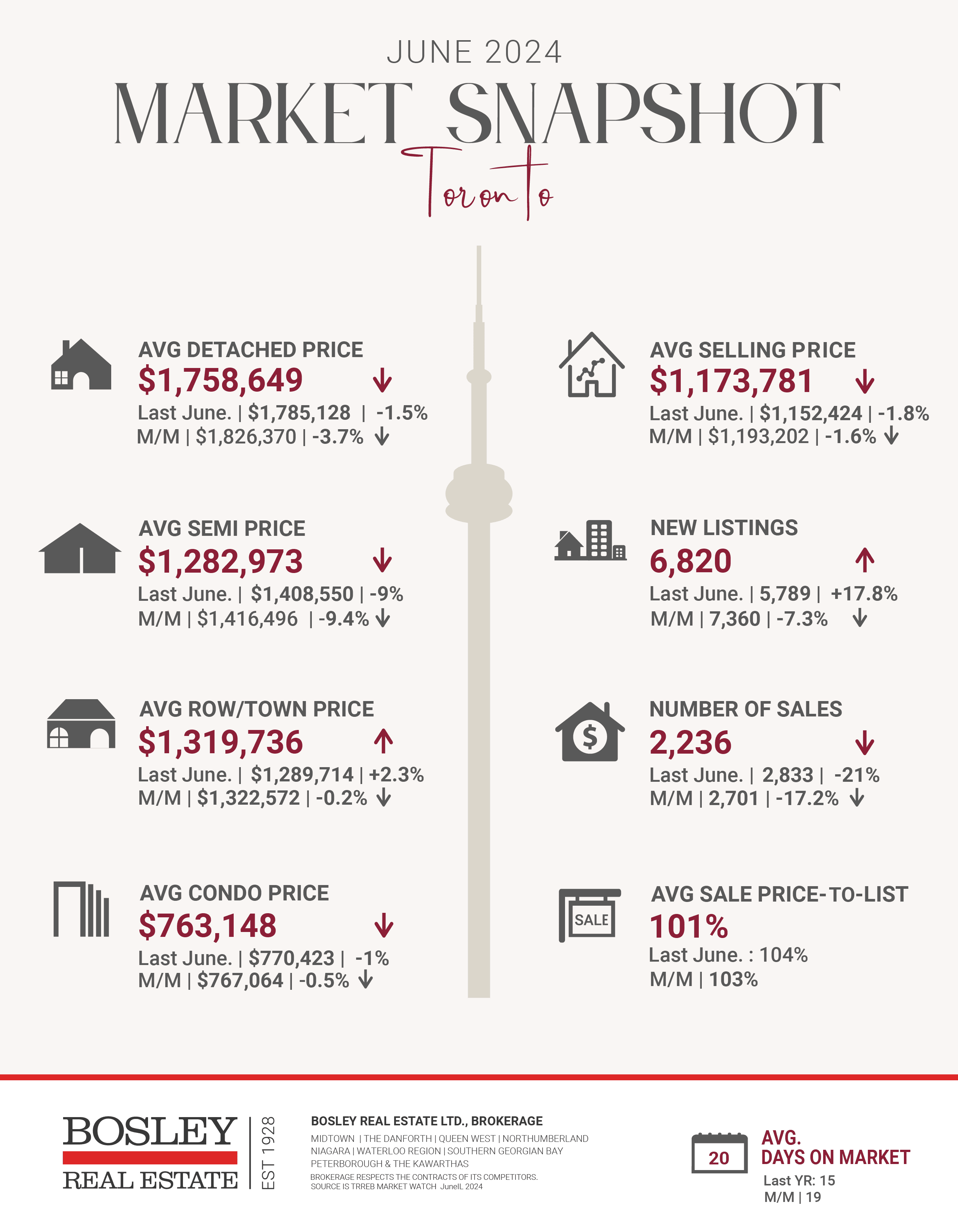

People’s enthusiasm and ability to purchase a home in Toronto has justifiably hit a record low point, with more supply on the market than there has been in more than a decade, but modest sales numbers compared to previous years. Prices have remained defiant, though, falling only slightly in response to buyers sitting on the sidelines and waiting for affordability to change.

With slightly lower lending rates this summer and marginal declines in average prices in the city, the amount you now need to earn per year to be able to float the typical mortgage and other costs of being a new homeowner has gone down slightly — but is still a lot more than most salaries.

According to the newest report from Ratehub.ca, which crunches the numbers every month based on the average home prices and relevant rates in cities across the country, as of June 2024, you need to take in $214,360 per year to cover a standard Toronto mortgage. This is based on the $1,110,600 price tag of a home of any type in the region last month — which was $6,800 less than in May — and mortgage and stress test rates of 5.47 and 7.47 per cent, respectively.

The number accommodates for a 20 per cent down payment, 25-year amortization, $4,000 in annual property taxes and $150 monthly in heating.

“A slight dip in interest rates led to easier home buying conditions for some Canadians in June, as affordability improved in nearly half of the nation’s major markets,” Ratehub. ca says. “Fixed mortgage rates softened slightly in June as bond yields dropped in response to a quarter-point rate cut from the Bank of Canada on the 5th, with growing market optimism that more cuts are to come in the coming months. That, combined with softening home prices, led to improved affordability, even among Canada’s priciest cities.”

Toronto demands the second-highest income of any city for home ownership, after only Vancouver ($231,700), and far ahead of places like Fredericton ($70,230), Regina ($72,010) and St. John’s ($76,880).

Here are the top 5 trending stories of the week:

- Rate cut won’t improve affordability or increase housing sales, majority of Canadians say in Survey | “A significant majority of Canadians do not anticipate improved affordability or increased housing sales as a result of the Bank of Canada’s June rate cut, a new poll by market research firm Abacus Data says.”

- What To Do If Your Home Flooded In Toronto | “Home floods can happen to the best of us, even if you live in a sprawling multi-million-dollar Bridle Path mansion. Just ask Drake. Yesterday, the Toronto-based superstar joined countless other city residents and took to social media to post dramatic footage of a large flood that enveloped the floor of his luxurious home. While the images and videos of Toronto’s widespread floods made for captivating scrolling and sharing, the reality is that they left some serious damage for many shocked homeowners.”

- CREA cuts housing market forecast for 2024 despite June sales rising | “According to a news release, buildings are the country’s third-largest emitter of greenhouse gas (GHG) emissions, and nearly all building emissions are from space and water heating. The new strategy, known as the Canada Green Buildings Strategy, aims to make it easier for some Canadians to make energy-efficient home changes.”

- Significant savings and energy bill cuts coming for Canadians | “According to a news release, buildings are the country’s third-largest emitter of greenhouse gas (GHG) emissions, and nearly all building emissions are from space and water heating. The new strategy, known as the Canada Green Buildings Strategy, aims to make it easier for some Canadians to make energy-efficient home changes.”

- “A Record High”: Nearly 26,000 New Condo Units Going Unsold In GTHAchallenges | “Amid daunting borrowing conditions, unrelenting prices, and sales that have sagged to close to a 30-year low, new condominium inventory continues to sweat on the Greater Toronto and Hamilton Area’s market, new data from Urbanation shows. The research and consultancy firm released its latest analysis on the GTHA’s condo market on Thursday, revealing that unsold inventory hit “a record high” in the second quarter of 2024. Some 25,893 units were unsold by the end of June, and that figure is over 60% higher than both the 10-year and 20-year averages for the metric.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.