Toronto’s latest real estate figures suggest the housing market may be amid a rebound, according to some economists, though they caution that the full impact of elevated mortgage rates has yet to play out.

The December stats were released from the Toronto Regional Real Estate Board this week and data shows that the GTA saw 3,444 home sales in December, an 11.5 per cent increase compared to a year ago and that the average price for a home climbed 3.2 per cent to $1,084,692.

The average price for detached, semi-detached and townhomes all increased year-over-year by 2.5 per cent, 1.7 per cent, and 5.5 per cent, respectively, while condos saw a 3.1 per cent decrease. It’s been a challenging year for the condo market, which is largely driven by investors, many of whom are over-leveraged and have been selling their units at discounted prices.

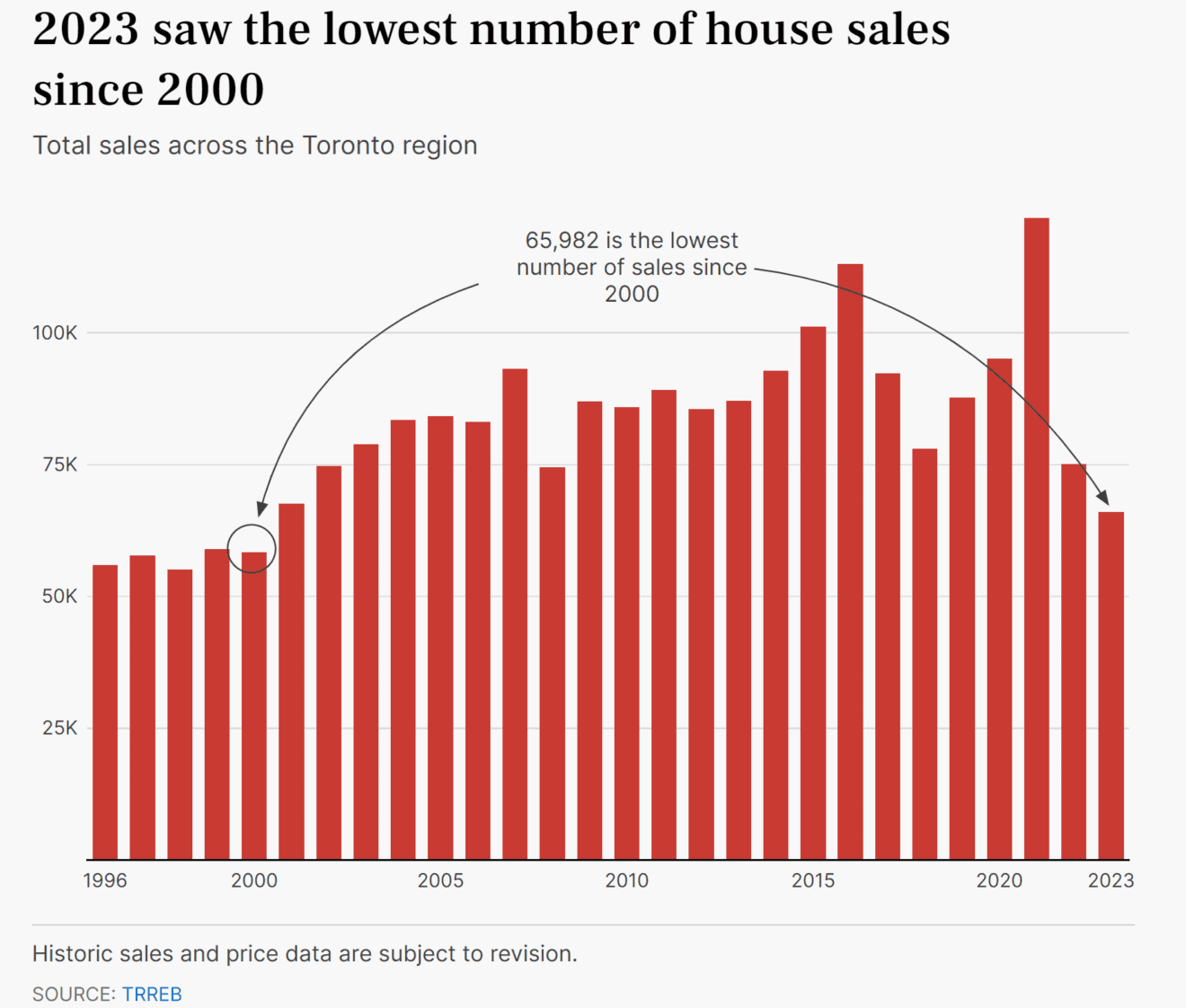

There were 65,982 total home sales reported through TRREB’s MLS® System in 2023, a 12.1 per cent dip compared to 2022, the lowest sales recorded since 2000, when Toronto’s population was two-thirds its current size and the average price of a home was $243,000. Even during the 2008 financial crisis, home sales hit 74,500. By comparison, home sales reached a record 121,700 during the 2021 pandemic real estate frenzy when buyers jumped into the market taking advantage of historically low-interest rates.

Despite an uptick during the spring and summer, the number of new listings also declined for the third straight month. The average selling price for all home types in 2023 was $1,126,604, representing a 5.4 per cent decline compared to 2022.

Buyers who were active in the market benefited from more choices throughout 2023. This allowed many of these buyers to negotiate lower selling prices, alleviating some of the impact of higher borrowing costs. Assuming borrowing costs trend lower this year, look for lighter market conditions to prompt renewed price growth in the months ahead.

There could be some relief on the horizon. Economists forecast that the Bank of Canada could begin to cut rates by April, allowing for renewed buyer interest. It could revive the market come spring. Already bond yields are trending down resulting in declining interest rates on five-year fixed mortgages.

Here are the top 5 trending stories of the week:

- Don’t Be Shocked By (Even More) Condos in (Even More) Toronto Neighbourhoods

“Density is the name of the game when it comes to the Greater Toronto Area’s (GTA) urban planning agenda – especially in areas surrounding current and upcoming public transit hubs. With new provincially-passed legislation as a driving force behind it, these neighbourhoods are in store for a drastic transformation in the not-too-distant future.” - Canada is losing residents at a record-breaking pace

“While Canada’s population continues to grow at staggering rates, the country is simultaneously losing residents at a record-breaking pace. According to Statistics Canada, in the third quarter, the country experienced the fourth-largest departure of its residents in the past 73 years. More than 32,000 people left the country, which is a 3% increase in emigration.” - ‘Cash for keys’ offers on the rise in Toronto, real estate professionals say

“Instances of landlords offering cash for tenants to vacate a unit have risen in Toronto, according to real estate professionals in the city. Real estate experts say the practice is still relatively uncommon, but they have been seeing it more frequently in Canada’s biggest city as landlords face financial pressures such as higher interest rates.” - These are the 5 most gorgeous projects completed in Toronto in 2023

“Toronto experienced another transformative year in 2023, bringing several jaw-dropping instant landmarks to the city. Condos remain the biggest player in the city’s ongoing development boom, but it was a handful of new institutional buildings and even a park that really stood out from the pack this year.” - What Experts Are Saying About Real Estate, Interest Rates In 2024

“It may be a new year, but it seems that Canadian real estate will face many of the same pressures it did in 2023. Interest rates and inflation will continue to be big-ticket issues in the year to come, as will the many facets of the housing crisis. At the same time, experts seem to be in agreement that some semblance of relief is on the horizon. Forecasts released at the tail end of last year say that 2024 could bring long-awaited interest rate cuts, a degree of mortgage relief, and perhaps a more eventful spring housing market.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.