The August stats are out for the GTA market and there were 4,975 home sales reported through TRREB’s MLS® System in August – down by 5.3% compared to 5,251 sales reported in August 2023. New listings entered into the MLS® System amounted to 12,547 – up by 1.5% year-over-year.

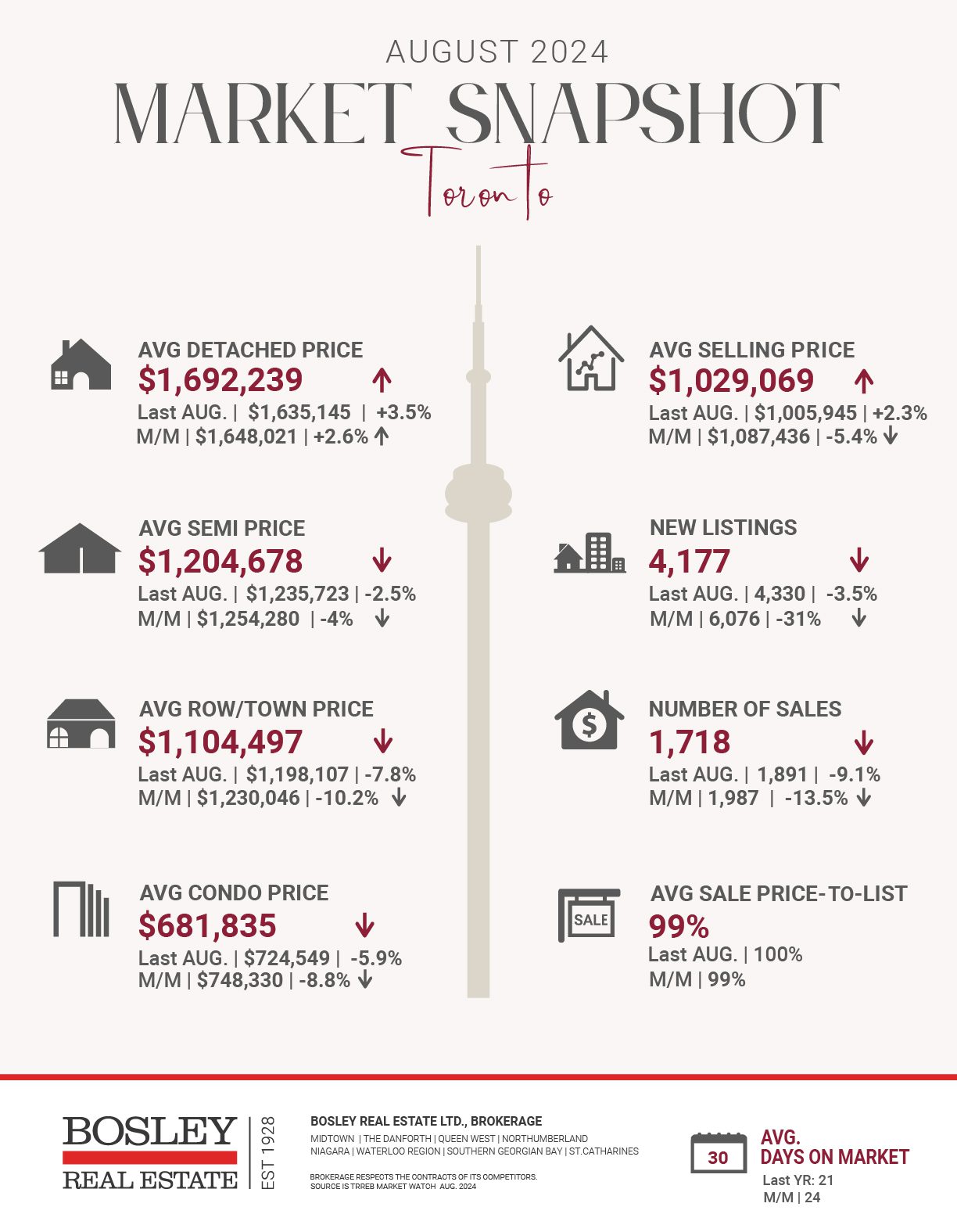

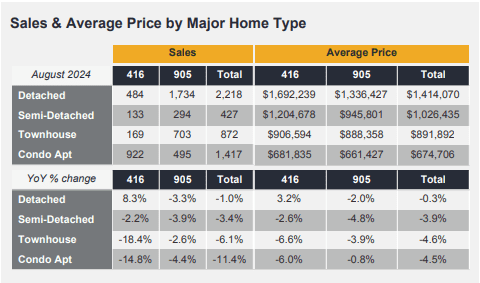

The average selling price for the GTA was down by 0.8% compared to August 2023 at $1,074,425. Meanwhile the average selling price for the City of Toronto is up 2.3% to $1,029,069 compared to last August’s price of $1,005,945.

In Toronto, condo prices have dropped 6% to an average price of $681,835 compared to last August’s price of $724,549, while the suburbs saw a 4.4% decrease coming in at $674,706 compared to last August’s price of $705,572.

Condo sales have suffered as first-time buyers have been priced out of the market and investors have fled due to high interest rates.

A lot of buying activity for the condo sector are usually first-time buyers and now they have a lot of negotiating power due to an oversupply of units. As buyers return and supply dries up, investors will likely re-enter the market.

Condo prices have also remained sticky with sellers unwilling to drop asking prices to reflect market value, especially those who bought at pandemic highs and are clinging to hope on making a profit.

The rest of the market continued to struggle in August as homes sat on the market for an average of 28 days — a 40% increase compared to the same time last year when it was only 20 days.

Buyers have more choice and can afford to take longer to get a deal done.

Meanwhile, a new report by digital real estate platform Wahi says 70% of homes purchased across the GTA in August sold for less than the listed price, 27% of homes sold above the asking price and 3% sold at the asking price.

Historically, the GTA’s real estate market is known for its lack of supply, but there is now plenty of choice. The last time this happened was during the 2008-09 financial crisis and the early months of the pandemic. As interest rates continue to drop, active listings will also decrease.

Here are the top 5 trending stories of the week:

- Canada’s inflation rate dips to 2.5% in July, lowest since March 2021 | “In a widely anticipated move, the Bank of Canada (BoC) has announced another quarter-point decrease to its policy interest rate, bringing it down to 4.25%. This marks the third consecutive meeting to culminate in a quarter-point cut.”

- How will the Bank of Canada’s rate cut impact real estate? | “While experts say the Bank of Canada’s previous two rate cuts did little to stimulate the housing market, opinions differ on whether the latest cut will increase activity. The Bank of Canada cut its key policy rate by 25 basis points to 4.25 per cent on Wednesday, marking the third consecutive cut after two previous quarter-percentage-point cuts in both June and July.”

- Toronto is cracking down more on Airbnbs and here’s how the rules are about to change | “Property owners in Toronto hoping to offset their high mortgage payments with income from Airbnb or Vrbo will have more hoops to jump through starting later this month as the City moves to crack down harder on those who may be contravening our stiff short-term rental bylaws.”

- Bank of Canada’s policy interest rate could dip to 2.75% by late 2025: forecast | “Looking ahead, the Bank of Canada may reduce its policy interest rate to 3.75% by the end of 2024, with further cuts potentially bringing it down to 2.75% by the close of 2025. That is the latest forecast by Credit 1 Economics Centre, which anticipates a continuous downward trend for the policy interest rate with incremental drops of 0.25% of about at least once every quarter next year.”

- The Average Home Mortgage Payment in 2024: US vs. Canada | “Do you ever find yourself thinking about moving to another country for a more affordable mortgage? While there are many reasons to explore the world, a cheaper mortgage might not be one of them — especially if you’re choosing between the U.S. and Canada.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.