Toronto rents hit three-year low but brace for a swift comeback: Urbanation

Toronto’s housing market offered a rare moment of relief for renters, as average rents dropped for the first time in three years. According to Urbanation Inc., a real estate consulting and market research firm, average condo rents were down 1.2 percent year-over-year in the second quarter — the first annual decline since 2021, following the onset of the pandemic. However, Urbanation warns the reprieve isn’t likely to last long.

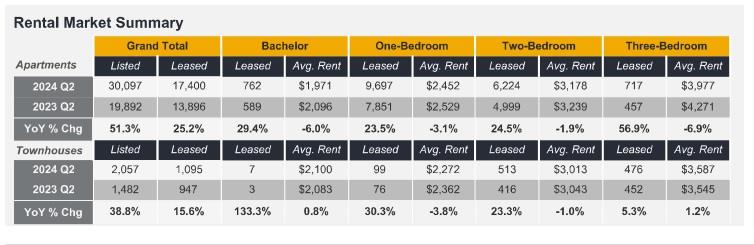

The firm’s latest report shows the average condo rent now stands at $3.97 per square foot in Toronto, translating to $2,723 a month for a typical 686-square-foot unit. Studio apartments had the sharpest decline, with rents falling 3.9 percent to $2,047 for a typical 395-square-foot unit. One-bedroom units weren’t far behind, decreasing by 1.8 percent to $2,450 for 591 square feet.

Rental rates for two bedrooms dipped by 0.9 percent, averaging $3,143 for 889 square feet, while three-bedroom units held relatively steady, declining just 0.6 percent to $3,988 for 1,041 square feet.

The 905 area was the only region where rents increased, rising 2.0 percent to $2,610 for a 719-square-foot unit. In contrast, average rents in the City of Toronto fell by 2.1 percent to $2,765 for a 674-square-foot unit.

Despite the drop-in rates, demand for rental units remains high. Toronto had a record 16,169 condo lease transactions in the second quarter, a 29 percent rise from the previous year. Typically, high demand applies upward pressure on prices, but due to the surge in listings, rents have decreased.

“Rental supply from condos is set to slow down for the rest of the year,” he added. In the first quarter of 2024, there were 12,132 condos completed in the GTHA. For the rest of the year, Urbanation projects an additional 13,261 units — about equal to what was delivered in the first few months of the year.

“So, with supply moderating and demand remaining strong, I don’t see rents declining much further, especially with vacancy remaining low,” Hildebrand says. “We don’t have an official rent forecast for this year but suffice it to say this will be a slower-than-normal year for rent increases in the GTA.”

And in a few years around 10,708 new condo units in Toronto have an advertised occupancy date in 2028, Hildebrand said, but “what gets delivered that year may be very different. Rents should continue rising as construction falls short of demand.”

Despite the drop-in rates, demand for rental units remains high. Toronto had a record 16,169 condo lease transactions in the second quarter, a 29 percent rise from the previous year. Typically, high demand applies upward pressure on prices, but due to the surge in listings, rents have decreased.

Here are the top 5 trending stories of the week:

- Posthaste: Toronto’s condo market is facing its biggest test since the 1990s recession | “Canadian housing markets have taken some knocks over the past few years as interest rates and inflation soared, but few have had it as rough as Toronto’s condo market. While the low-rise market in the Greater Toronto Area is holding its own, conditions in the condo market are deteriorating to levels not seen in decades, says a report by Benjamin Tal, deputy chief economist at CIBC Capital Markets, and Shaun Hildebrand, president of Urbanation.”

- Mortgage Digest: First-time buyers relying on gifted down payments more than ever | “Home floods can happen to the best of us, even if you live in a sprawling multi-million-dollar Bridle Path mansion. Just ask Drake. Yesterday, the Toronto-based superstar joined countless other city residents and took to social media to post dramatic footage of a large flood that enveloped the floor of his luxurious home. While the images and videos of Toronto’s widespread floods made for captivating scrolling and sharing, the reality is that they left some serious damage for many shocked homeowners.”

- Over 80% of Toronto area investors are losing money on new condos | “A new report from CIBC and Urbanation released on Thursday reveals that the majority of condo investors in the GTA are losing money every month as the market faces the most “significant test” since the 1991 recession. Although the low-rise market appears to be in relatively good shape, the same cannot be said about the GTA condo market, which, according to the report, is in “recessionary territory with conditions deteriorating to levels not seen in decades.”

- Tenants fight back as landlords seeking own-use evictions rise 85% in Ontario | “In a hot Toronto real estate market, both tenants are paying well below market rent for their units in a low-rise building in East York. And now their landlord wants them out. According to their eviction notices, the landlord plans to move family members into both apartments. “I think the only reason he wants me to leave is so he can charge higher rent,” said Kostav, who is retired after working as an electrician and has lived in the studio unit for nearly 20 years.”

- Bank of Canada cuts interest rate, signals more to come if inflation keeps dropping | “The Bank of Canada has decreased its policy interest rate for the second consecutive time and signalled more cuts are coming if inflation continues to ease. The 25 basis points reduction brings the overnight rate to 4.5 per cent, returning to levels not seen since June 2023. Last month’s cut from 5 per cent to 4.75 per cent was the first in more than four years.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.