The real estate market can be unpredictable, but there are definitely moments when conditions align favorably for buyers, and this could be a good opportunity to buy a first home. As weak as housing affordability is right now, aspiring young buyers may never see a better time to buy.

Mortgage rates have declined lately, and home prices are moving sideways on an average national basis. Short of a crash that sends prices reeling, this is what passes in Canada for a buying opportunity.

The question is how long this moment lasts. After the last set of national data on residential

resale homes, the Canadian Real Estate Association jumped on expectations for lower interest rates and made this startlingly unequivocal prediction: “the forecast for a rekindling of Canadian housing activity going into 2025 has just gone from a layup to a slam dunk,” said Shaun Cathcart, CREA’s Senior Economist.

Other voices were more cautious, but there’s still a consensus that a housing rebound lies ahead. Anyone considering a first home should be mindful of this outlook. If housing rebounds with any enthusiasm, today’s market conditions just might be a generational opportunity to buy a home.

In many big cities, houses are very far from affordable for first-time buyers without high incomes or high-income parents. Also, a lot of people feel terrible about their finances after the last couple of years of high interest rates and inflation.

But Canada’s housing market has a few things going for it, starting with the religion-like belief that owning a house is a flat-out, financial win. This has not been the case for those who bought at the market peak in 2021-22, but boomers and even Gen Xers have cleaned up on home equity in the past decade or more.

Falling interest rates are a direct support for housing. On September 4th we could possibly see another 25-basis interest rate cut which could likely stimulate homebuyer demand.

The July numbers for the resale market suggested rate cuts to date haven’t done much so far to revive housing, but mortgage rates have come down to the point where the currently popular three-year fixed rate mortgage can be had for as little as 4.5 per cent to 4.8 per cent.

Other supports for housing include population growth and the economy’s resilience so far in avoiding recession. As of August 20th, Canada’s inflation cooled to a 40-month low of 2.5% in July.

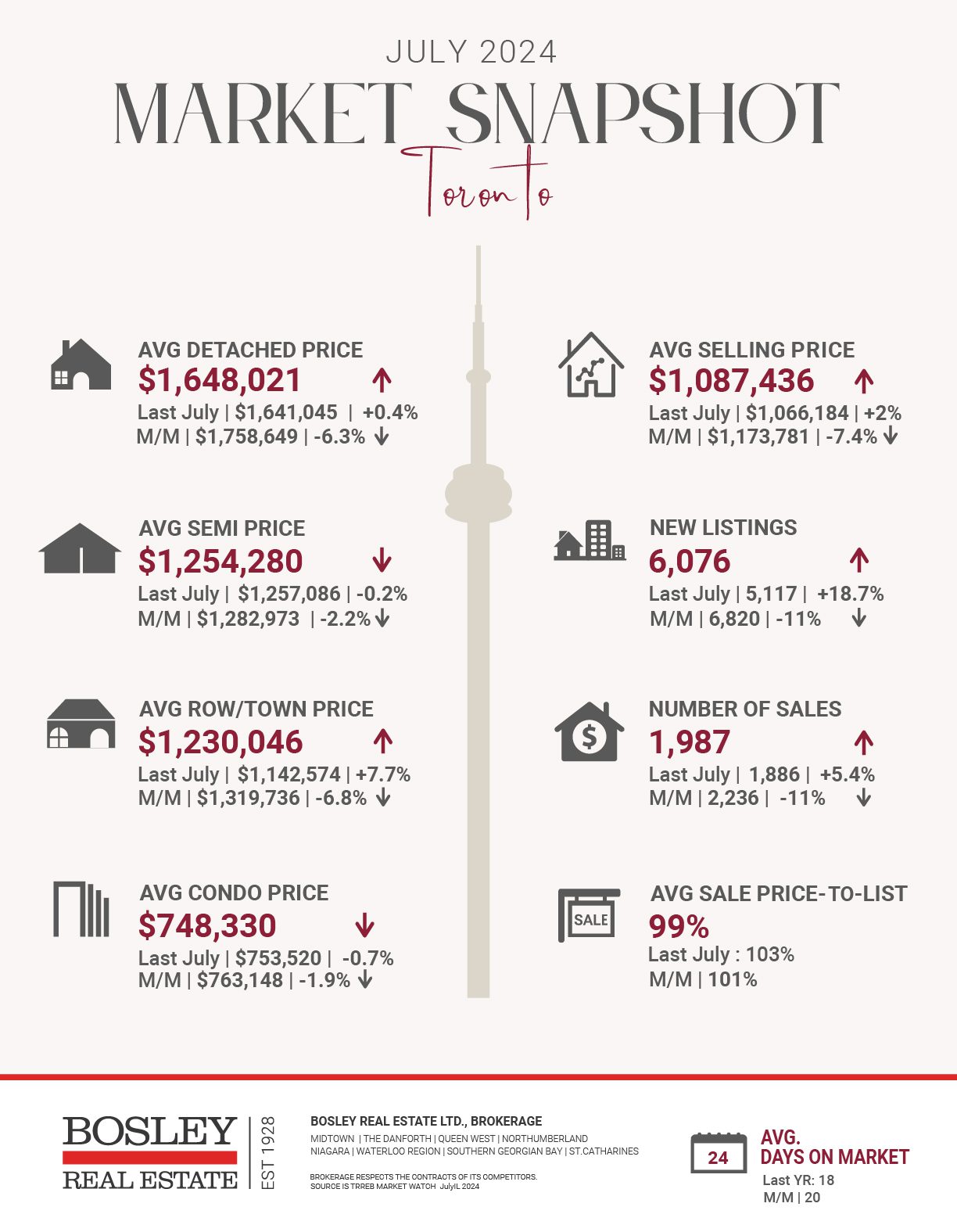

As ever, the outlook for housing varies a lot between cities. The MLS Home Price Index showed Toronto and Vancouver were down 5 per cent and 0.8 per cent, respectively, on a year-over-year basis in July, while Calgary was up 8 per cent and Edmonton was up 7.2 per cent. Canada-wide, the index was down 3.9 per cent.

Today’s buying opportunity is based on modest price declines in some locations combined with falling mortgage rates. The overall improvement in affordability is modest, but at least it’s something. In a more robust housing market, it’s likely that demand from buyers would result in price gains that more than offset lower borrowing costs.

Here are the top 5 trending stories of the week:

- Bank of Canada’s policy interest rate could dip to 3.75% by late 2024: forecast | “By the end of 2024, the Bank of Canada’s policy interest rate could be 1.25% lower than the recent peak rate of 5%.This is according to a new forecast this week by Central 1 Credit Union, which believes that, based on inflation and economic performance outlooks, there is much room for further rate cuts through the end of 2024.The three remaining scheduled policy interest rate announcements before the end of 2024 are expected to send the rate down to 3.75%.”

- Canada’s inflation rate dips to 2.5% in July, lowest since March 2021 | “Canada’s annual inflation rate dropped to 2.5 per cent in July — down from 2.7 per cent in June, Statistics Canada said Tuesday. The national statistics agency said inflation increased at the slowest pace in more than three years, since March 2021. The deceleration was attributed in part to lower prices for travel as compared to a year earlier, when travel tours, airline tickets and accommodation soared in the first summer without COVID-19 restrictions.”

- Income required to buy a home has dropped in major Canadian cities | “Do you dream of owning a house? The average home purchase income has decreased in several major Canadian markets. In June, the Bank of Canada lowered its key interest rate to 4.75%, and in July, it dropped again to 4.5%, the second rate cut of the year. According to a study by Ratehub.ca, an online financial tool, these cuts have lowered the benchmark interest rate from 5% to 4.5 nationwide. As a result, affordability has improved for homebuyers across several Canadian cities..”

- CREA Predicts 2025 Will Be A “Slam Dunk” For Home Sales, Despite Slow July | “After a somewhat promising June, data from Canadian Real Estate Association’s (CREA) July 2024 statistics report reveals housing market activity effectively stalled in July, despite the July 24 interest rate cut. In June, the “fledgling” market saw slight increases in month-over month sales, tighter year-over-year market conditions, and the national average home price increase for the first time in 11 months. But in July, progress halted, with home sales ticking down 0.7% from June’s 3.7% month-over-month increase.”

- Parking spots are adding a ridiculous amount to the cost of Toronto condos | “Trying to find parking in Toronto is almost always guaranteed to be an arduous and costly affair, with fewer and fewer options as old spaces or entire lots are converted to housing, parks, bike lanes and more — something that most celebrate as big wins, but which some drivers and business owners may resent.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.