MARKET INSIGHT FOR THE WEEK ENDING November 24th

Why the Bank of Canada could cut interest rates much more than markets expect.

Why the Bank of Canada could cut interest rates much more than markets expect.

The Bank of Canada is widely expected to hold its benchmark interest rate when it meets next week, but a lot has changed since October.

Cooling inflation, here and south of the border, and a weakening economy have turned markets’ attention from rate hikes to rate cuts.

Investors are now fully pricing in a 25-basis points rate cut by April, a 75 per cent chance by March, and even a 20 per cent chance by next week.

Stephen Brown, deputy chief North American economist for Capital Economics, thinks odds of a cut as early as next week are way off the mark, but also believes markets are underestimating the degree of policy loosening to come in 2024.

Capital expects the Bank will tone down or even drop its tightening bias next week because of developments since its last meeting in October.

Oil prices, a big driver of inflation, have fallen back after a spike over the Israel- Hamas war to below what the Bank forecast in its October monetary policy report. Gas prices are at their lowest since March.

Capital now expects that headline inflation will average 3.1 per cent this quarter compared to the Bank’s forecast of 3.3 per cent.

The economy is also looking weaker than the Bank expected, said Brown. Gross domestic product data out today showed the economy in the third quarter shrank at a 1.1 per cent annualized pace, weaker than the Bank’s forecast of 0.8 per cent.

He also expects that jobs data out tomorrow will show a small rise in unemployment and slowing wage growth, “which should help to soothe the Bank’s lingering fears about wage pressures.”

Despite some tough talk on inflation, Bank of Canada governor Tiff Macklem “has now dangled the prospect of rate cuts a few times,” said Brown.

The governor repeated last week that cuts can begin before inflation falls to the 2 percent target as long as there is a clear trend that it is headed that way.

Capital estimates that the Bank will need to see this trend for almost six months, making March or April the most likely meetings for cuts to begin.

But while markets expect only 95 basis points of cuts over 2024, Capital believes the Bank will need to cut more than twice as much.

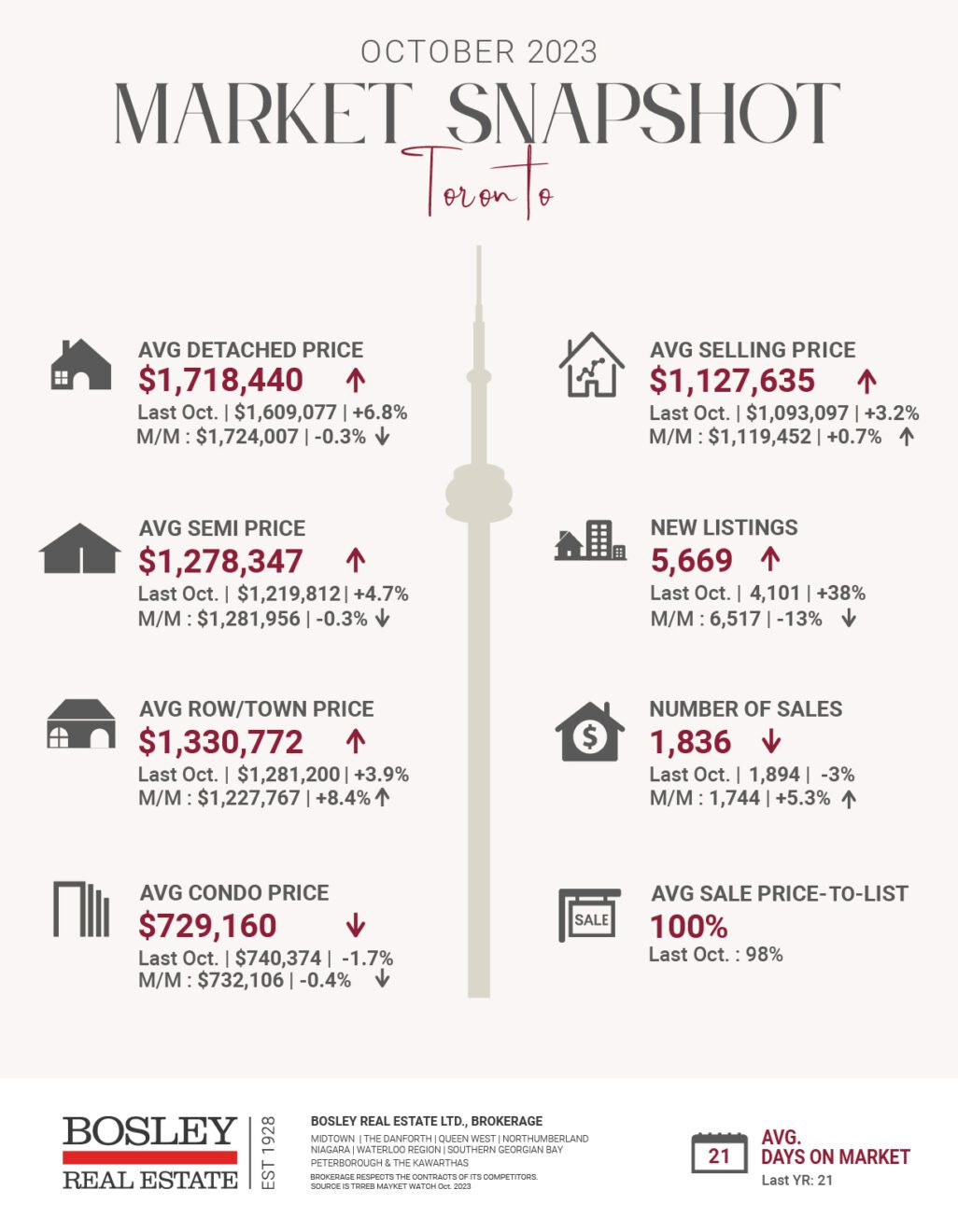

One sticking point could be the housing market. While home prices are coming down, the Bank may take a more cautious approach to avoid fueling another rally.

Yet, the sales-to-new listing ratio recently fell to its lowest since 2013, meaning that home prices could drop even more than the 5 per cent Capital is predicting by March.

“At a time when house price declines are gathering pace, … right now one can just as easily make the opposite argument that the Bank will need to act aggressively to prevent the housing market from falling into a tailspin,” he said.

Here are the top 5 trending stories of the week:

- Global investors sensing opportunity in Canada’s housing shortage: Colliers “Canada’s housing shortage is starting to draw the attention of global investors who are likely to favour Canadian multi-family properties in 2024, a major real estate investment management firm says.”

- Inventory Levels Climb In GTA As Builders ‘Test The Waters’ With New Launches “After seeing a massive leap between August and September, new home sales in the GTA essentially flatlined in October, with 1,872 sales recorded. That figure is down around 0.7% month over month and 7% year over year. It’s also 50% below the 10-year average for new home sales in the region. New condominium apartments (including units in low-, medium-, and high-rise buildings, as well as stacked townhouses and loft units) accounted for the bulk of sales activity in the month, with 1,304 units sold. That figure is up 1% month over month, but down 20% year over year and 49% below the 10-year average.”

- Most Canadians Now Think Immigration Is Too High: Leger “Canada is known for its generous immigration policies but that might change soon. A new survey from Canadian Press and Leger looked at the public opinion on immigration and its impact on services. Most households feel Canada is pursuing an overly aggressive immigration policy contributing to an affordability crisis, and a net negative impact on the economy.”

- You can buy a home for under $500,000 in these Canadian cities next year “Homes under $500,000 feel like a distant dream for many Canadians. But despite the bleak state of the housing market, Canadians’ outlook on homeownership remains positive, according to a new report. Re/Max Canada says that after 2023’s housing shortage and interest rate hikes, 73% of Canadians are still “confident that home ownership is the best investment.”

- Canadian Rents Outpace Income For The First Time In 60 Years: BMO “Canadian real estate prices are still seeing record growth, just not when it comes to sales. A new research note from BMO shows annual growth of rental prices grew at a record pace in October. They note the issue is complicated even further by rents outpacing income growth for the first time in 60 years.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.