May home sales continued at low levels, especially in comparison to last spring’s market activity. Home buyers are still waiting for relief on the mortgage rate front which they got this week when the Bank of Canada dropped interest rates 25 basis points to 4.75%. Existing homeowners are anticipating an uptick in demand, as evidenced by a year-over-year increase in new listings. With more choice compared to a year ago, buyers benefitted from more negotiating room on prices.

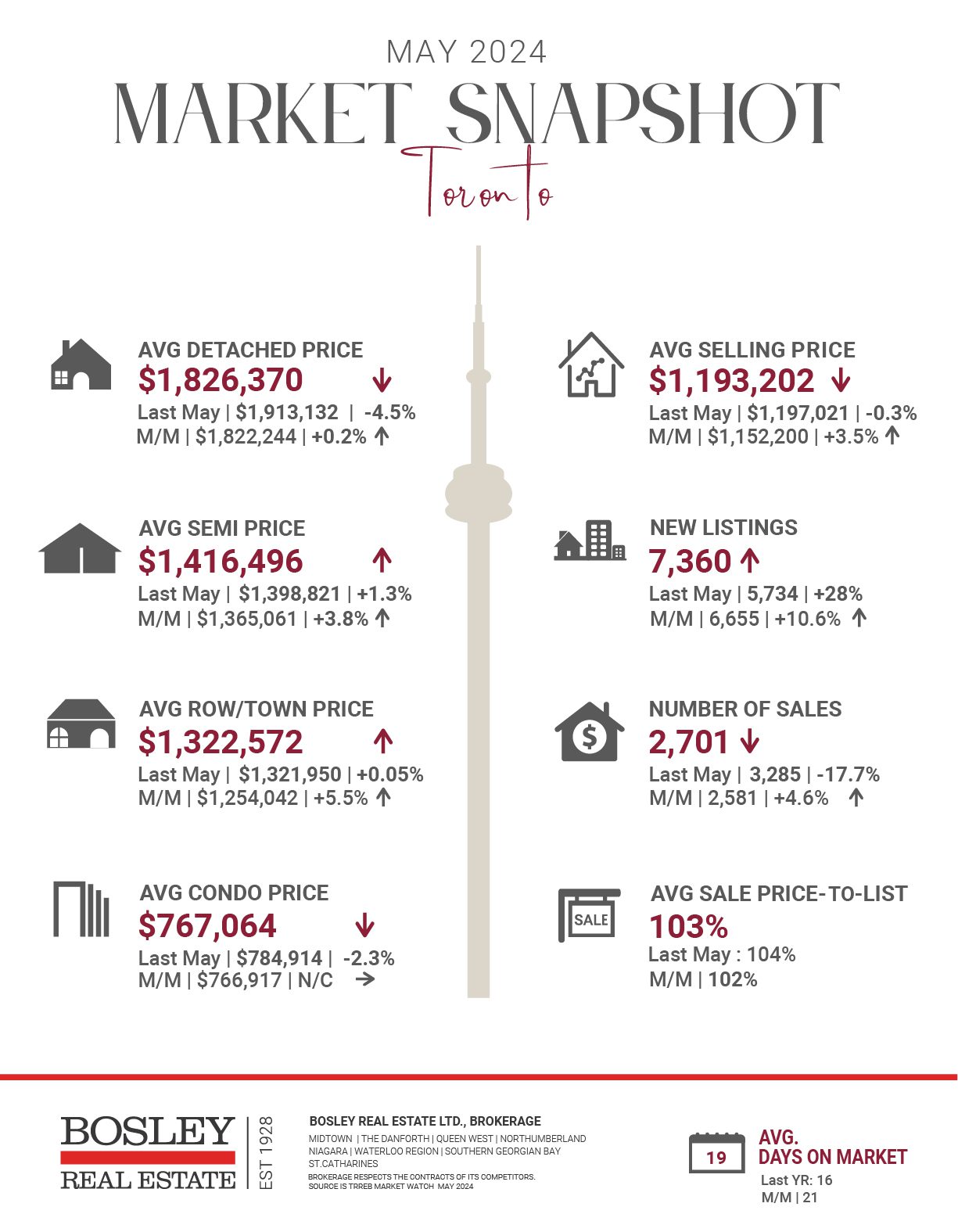

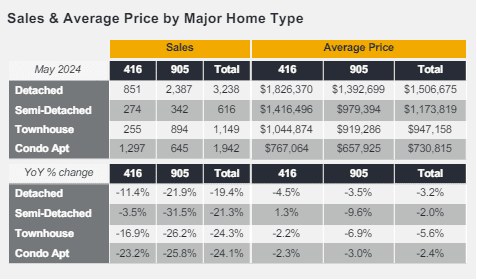

Greater Toronto Area REALTORS® reported 7,013 home sales through TRREB’s MLS® System in May 2024 – a 21.7% decline compared to 8,960 sales reported in May 2023. New listings entered into the MLS® System amounted to 18,612 – up by 21% year-over-year.

The average selling price of $1,165,691 was down by 2.5% over the May 2023 result of $1,195,409. On a seasonally adjusted monthly basis, the average selling price edged up slightly compared to April 2024.

Despite a glut of active listings on the market, particularly for condominiums, prices seem to remain stable. The average price for the GTA was $730,815, down 2.4% over May of 2023, but up slightly month-over-month.

At the end of May, Greater Toronto had the highest number of condo units for sale for any month in recent history with 8,183 apartment units on the market. The last highest number of active condo listings was 7,600 in October 2020.

“While interest rates remained high in May, home buyers did continue to benefit from slightly lower selling prices compared to last year. We have seen selling prices adjust to mitigate the impact of higher mortgage rates. Affordability is expected to improve further as borrowing costs trend lower. However, as demand picks up, we will likely see renewed upward pressure on home prices as competition between buyers increases,” said TRREB Chief Market Analyst Jason Mercer.

Olivia Cross, North America economist at Capital Economics, notes that recent data shows continued strength in household consumption in the first quarter, which was a surprise given weaker retail sales numbers, in her opinion. Statistics Canada reported last week that real gross domestic product rose at an annualized rate of 1.7 per cent in the first quarter.

“The strength of consumption suggests that interest rates are not taking quite as heavy a toll on households as we previously thought, and the economy appears to have carried more momentum into the second quarter than either we or the Bank expected,” Ms. Cross says in a note to clients.

Here are the top 5 trending stories of the week:

- Bank of Canada Rate Cut: How It Alters The Housing Market | “It happened. The Bank of Canada finally lowered its overnight rate. It was a characteristically cautious reduction — 5% to 4.75% — but as the Bank’s first rate cut in over four years, it brings with it a certain sense of cloud-parting. “With continued evidence that underlying inflation is easing, Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points,” the Bank of Canada stated in a press release..”

- A Rate Cut Is Welcome, But Don’t Expect A Construction Surge Quite Yet | “Over the past year, the development industry across Canada has slowed down significantly, and the high cost of borrowing has often been cited as one of the biggest culprits. Experts are now warning, however, that even when rates are cut, as they were this morning, a construction boom is not something to be expected immediately.”

- Here’s how much you need to earn to buy a home in Toronto right now | “Although mortgage rates in Canada are starting to trend lower, there’s sadly little relief on the horizon for prospective homebuyers, as affordability conditions continued to worsen in most cities — including Toronto — throughout the month of April. The latest affordability analysis by Ratehub.ca paints a somber picture of the country’s current real estate market, finding that it became tougher to qualify for a mortgage in 10 out of 13 major markets in Canada last month due to rising home prices. “

- Number of construction workers in Canada reaches all-time high, but housing starts lag | “According to a new report by the Canada Mortgage and Housing Corporation (CMHC), the number of construction workers in Canada reached a record high of 650,000 in 2023. All the while, according to CMHC’s calculations, the number of housing starts recorded across the country in 2023 reached about 240,300 units, which is below the maximum potential of building well over 400,000 homes per year.”

- City Of Mississauga Announces Free Garden Suite Building Plans | “Today, the City of Mississauga announced the newest step in their Housing Action Plan: free design plans for garden suites. The program is meant to kill two birds with one stone. On the city level, it moves the municipality closer to achieving the goals laid out in its action plan (getting more homes built, streamlining building approvals, and making homes more affordable), while for individuals already grappling with high housing prices, costs are reduced.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.