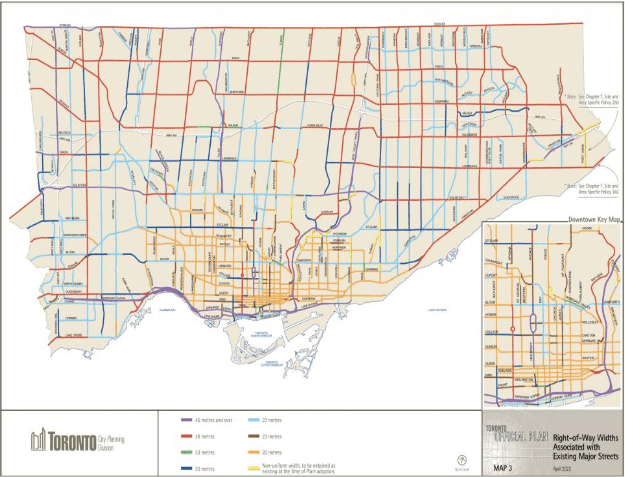

Toronto City Council approves townhomes and small six-storey residential units along major roads.

City council voted 21-3 last week to officially allow developers to erect buildings of up to six storeys and 60 units on specific major roads without having to apply for rezoning applications or minor variance. Seeking those permissions added cost and time to projects, making some developments unfeasible.

City staff said erasing those requirements will unlock development on more than 31,000 lots across Toronto. Staff originally proposed allowing up to 30-unit apartments but agreed with council recommendation to double the limit to make more developments financially viable.

While the city doesn’t have a formal definition of what qualifies as a “major street” spokesperson Christy Abraham said they are key corridors connecting different parts of Toronto and lined with diverse businesses, employment areas, parks, schools and residential areas.

“These streets serve as the backbone of Toronto’s transportation network, provide opportunities for gradual intensification, and are able to support diverse housing options,” Abraham said.

Some suburban councillors tried to exempt some streets from the change, arguing density would overwhelm neighbourhoods dominated by single-family homes. They were all outvoted as Mayor Olivia Chow and housing chair Coun. Gord Perks said all parts of the city must help end the crisis that has made renting and buying too expensive for many Torontonians.

“By building this way we’re saying ‘Yes’ to more neighbours, we are saying ‘Yes’ to newcomer families … that’s how we can build more than homes,” Chow said. “We are building dreams because we are building hope. If we don’t do that it’s very difficult for people to be able to stay in Toronto.”

It’s the latest in a series of policy changes aimed at forcing more and different options in neighbourhoods long dominated by single-family homes. Council has greenlighted new housing forms like laneway and garden suites, and last year approved permission to build multiplexes citywide.

Here are the top 5 trending stories of the week:

- The Cost Of Not Doing Business: Billions Lost As New Condo Projects Shelved In GTA | “On a single job site, Nick Ainis’s construction-management business employs hundreds of sub-contractors. Combined, his army of trades can log upwards of a hundred thousand well-paid hours putting up a mid-sized condo building. But, as developers delay project launches in response to the higher interest rates that have pushed away potential homebuyers, he and his labourers see their prospects in the formerly booming market dwindle. “It’s hard to get new work in this environment, because everybody’s holding off,” says the founder and CEO of Fusioncorp Developments Inc., a construction-management company.”

- Canadian Business Growth Is The Slowest In Years, Monthly Closures Rise“Canada’s booming population isn’t enough to save its eroding business environment. Statistics Canada (Stat Can) data shows business growth continued to slow in February, despite the rapidly escalating population. Even more business owners are deciding to shutter their doors as unemployment rises and incentives to operate continue to fade.”

- Here’s how much you need to earn to buy a home in Toronto right now | “Although mortgage rates in Canada are starting to trend lower, there’s sadly little relief on the horizon for prospective homebuyers, as affordability conditions continued to worsen in most cities — including Toronto — throughout the month of April. The latest affordability analysis by Ratehub.ca paints a somber picture of the country’s current real estate market, finding that it became tougher to qualify for a mortgage in 10 out of 13 major markets in Canada last month due to rising home prices. “

- What to expect from next week’s Bank of Canada interest rate announcement | “The Bank of Canada (BoC) will issue its fourth interest rate update of the year on the morning of Wednesday, June 5. Canada’s central bank kept the key interest rate at 5% in January, March, and April. In its last update, the BoC said it had revised its forecast for global GDP growth to 2.75% in 2024 and about 3% in 2025 and 2026. Officials added that inflation continues to slow across most advanced economies, although progress “will likely be bumpy.” “Inflation rates are projected to reach central bank targets in 2025,” a release about the last update on April 10 reads.”

- Support for first time homebuyers in Ontario | “Today, through the Shared Equity Mortgage Providers (SEMP) Fund, the federal government announced a $5 million repayable loan to Ourboro Inc. which will fund shared equity mortgages that they will provide directly to first time homebuyers in the Greater Toronto Area and select communities across Ontario.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.