If a foreign landlord fails to pay taxes, the CRA can go after the tenant. And not knowing a landlord is a non-resident is not considered a valid excuse.

Canadian renters are getting a rough introduction to the country’s foreign investor problem. The Canada Revenue Agency (CRA) just informed tenants they’re on the hook for any unpaid taxes their non-resident landlord may owe. In a bizarre decision, the nation’s tax authority is telling tenants who pay rent to non-resident landlords to withhold a portion and remit it on their behalf, or they may be liable for the amount with penalties.

Non-residents earning income in Canada are subject to a withholding tax, a general rate of income withheld to ensure the non-resident tax bill can be covered if they never file taxes. That includes any non-resident that receives rental income from property, and that the withholding rate is generally 25% of the gross income.

Last year, a tenant took the Minister of National Revenue to court, arguing that he did not know his landlord was a non-resident. The tenant, whose Italy-based landlord owned a single unit in a Montreal building, lost the Tax Court appeal on the grounds that they were a Canadian resident paying rent to a non-resident landlord, and were therefore required to withhold and remit 25 per cent of the rent to the CRA. The judge acknowledged “the harsh consequences,” in her decision, but still held the “resident payer,” or renter, liable.

According to the CRA, a payer (tenant) or agent (property manager) must withhold 25% of the gross rental income paid or credited to the landlord, and then submit it to the CRA within 15 days after they’ve paid rent. In addition, the tenant of a non-resident is required to file an NR4 tax form.

If the payer fails to withhold, remit the amount, and file an NR4—they may be held liable. The CRA also threatens they may charge interest compounded daily, as well as additional penalties on top of the amount.

To protect themselves, tenants could start asking for statutory declarations from their landlords, attesting to their tax residency status. But the landlord could move out of the country and their status changes, and the tenant doesn’t know.

99.99 per cent of all tenants in Canada are unaware of this rule, and it should be the responsibility of the CRA to inform the renting public that they could be on the hook for this withholding tax.

Here are the top 5 trending stories of the week:

- RBC Now Forecasting First Bank Of Canada Interest Rate Cut In June | “2024 is shaping up to be the year of the interest rate cut — on Canadian soil, at least. This is according to a report that came out last week from RBC Economist Claire Fan, which lays out five predictions for when the Bank of Canada, the US federal reserve, the Bank of England, the European Central Bank, and the Reserve Bank of Australia will begin lowering their respective policy rates..”

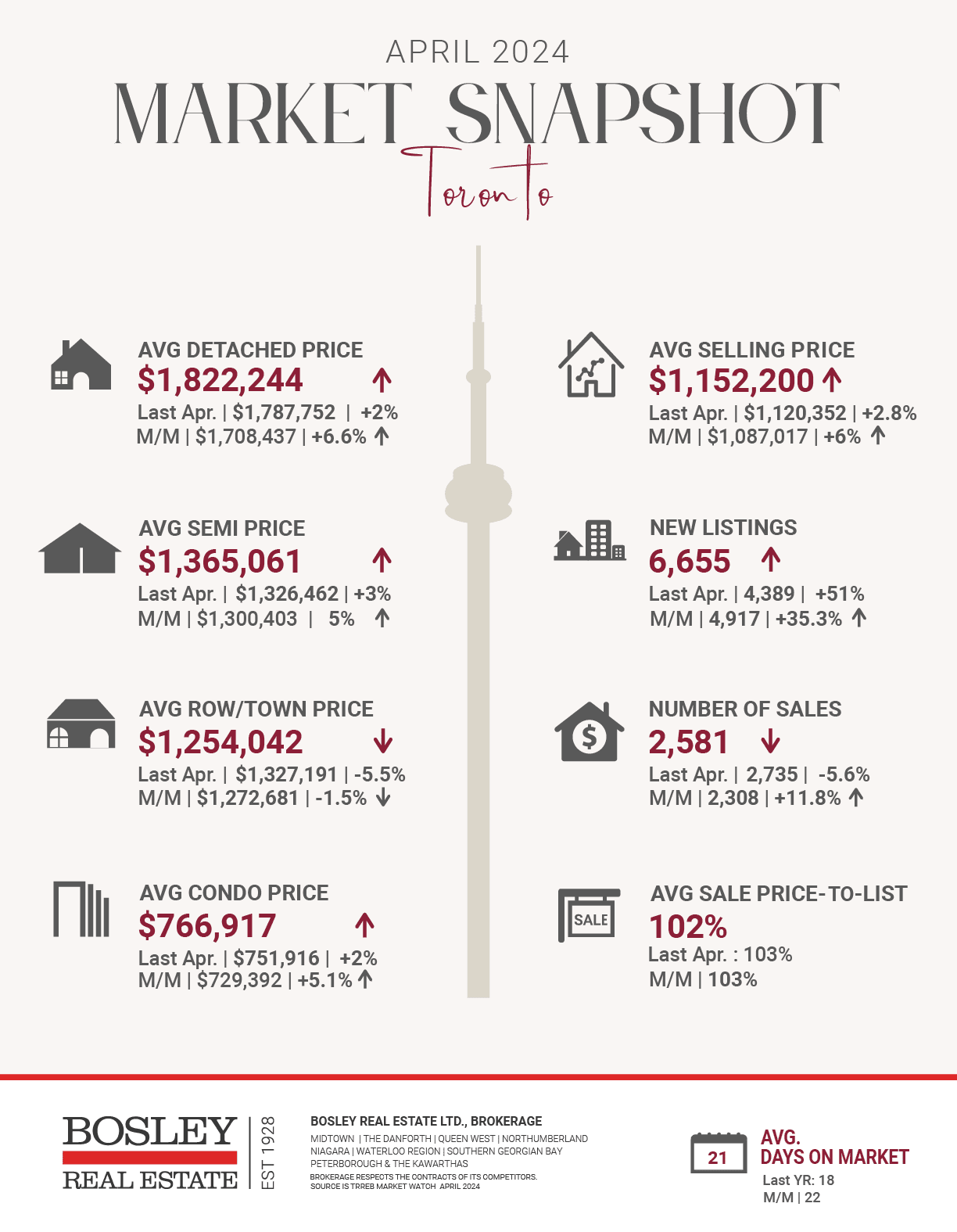

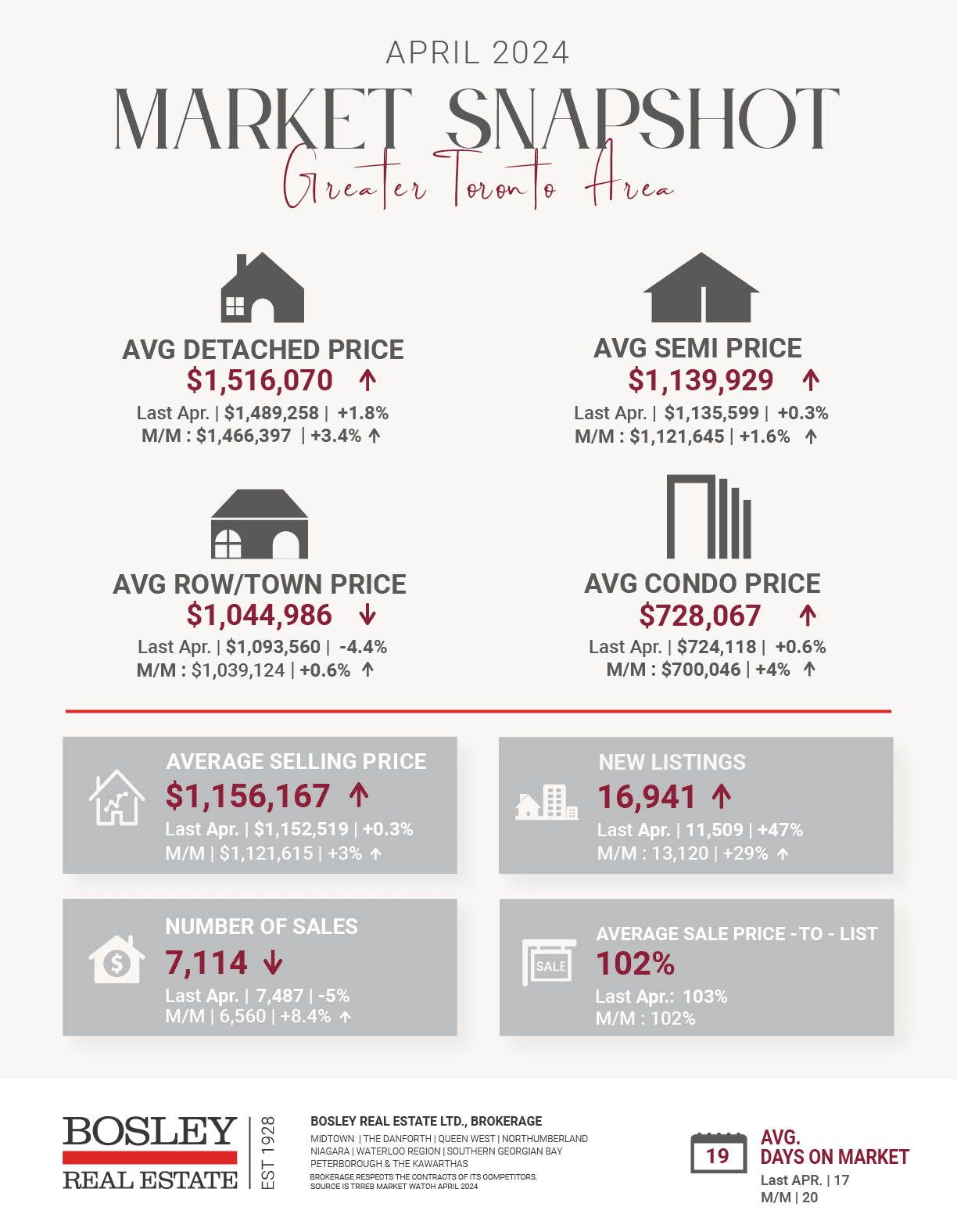

- Condo sales rise in the GTA as prices stabilize and renters eye homeownership | The GTA’s condominium apartment sales increased in the year’s first quarter to 4,747, compared to the same period of 2023 and up 5.3 per cent year-over-year, the Toronto Regional Real Estate Board (TRREB) reports. Plus, new condominium listings increased by 23 per cent during this time.

- Ontario’s Suburbs Have Lost Some Shine Among New Homebuyers: Report | “Ontario’s pre-construction market has taken a notable hit and the suburbs have lost some shine, according to the 2024 New Home Buyers Report by Tarion. According to the findings, Ontario’s homebuyers are sitting on the sidelines thanks to ongoing economic uncertainty. Based on Statistics Canada’s current population estimates, overall home purchase intentions in Ontario have declined by 25% in the past year, highlights the report.”

- Canada’s housing market sees surge in listings, giving buyers’ rare advantage | “A trend may be unfolding in Canada’s housing market, as the number of active listings continued to edge upward, rising sharply in April to reach its highest point in more than five years. The numbers heralded a shift toward a more balanced market, with home prices remaining stable and sales down marginally.”

- Toronto is catching up with Vancouver as Canada’s most expensive place to rent | “The cost of living isn’t showing any indication of easing up for owners or renters in Toronto, it seems, as high interest rates and prices continue to hamper affordability in the real estate market and rents are now back on the rise, too.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.