MARKET INSIGHT FOR THE WEEK ENDING November 3rd

Lack of affordability and uncertainty remained issues for many would-be home buyers in the Greater Toronto Area (GTA) in October 2023.

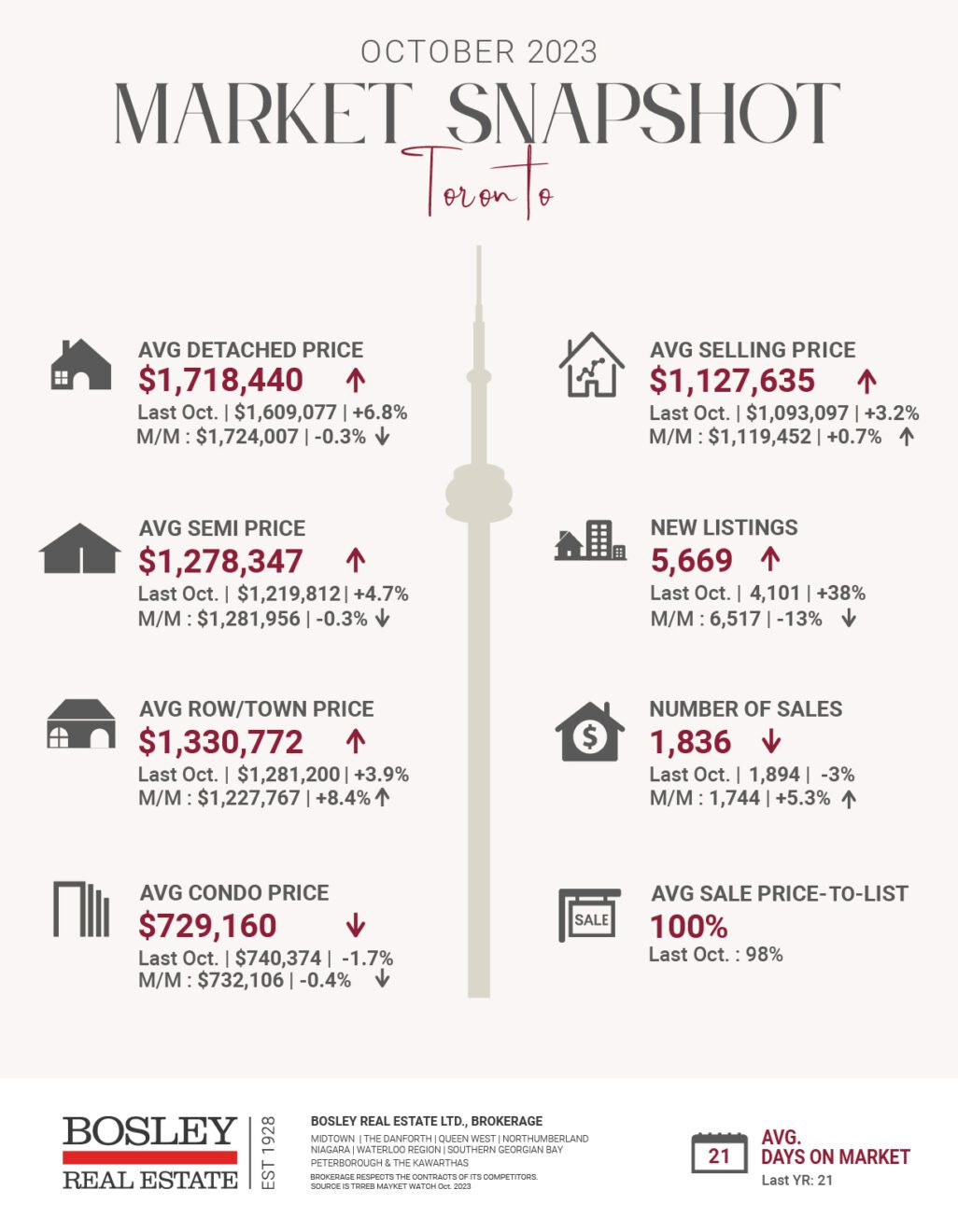

The report found average house prices edged up 3.5 per cent from last October, to $1,125,928. But condo prices across the GTA were down slightly by about one per cent to $708,780. Condos made up about 28 per cent of the sales that were reported to TRREB in October.

There were 4,646 sales across the region in October, down about six per cent since October 2022. Sales were also down compared to last month, on a seasonally adjusted basis.

Meanwhile new listings were up 38 per cent to 14,397, compared to last October (10,433) but 2022 saw a 12-year low in homes for sale, TRREB reported. The gains were less dramatic compared to the 10-year average.

The average detached home price is $1,450,112, up 6 percent compared to last October and the average semi-detached is $1,102,721 up 2 per cent.

“Competition between buyers remained strong enough to keep the average selling price above last year’s level in October and above the cyclical lows experienced in the first quarter of this year,” said Jason Mercer, TRREB’s chief market analyst, in a statement.

“However, home prices remain well below their record peak reached at the beginning of 2022, so lower home prices have mitigated the impact of higher borrowing costs to a certain degree.”

Though the Bank of Canada decided to hold interest rates at five per cent in its most recent announcement late last month, rates are still much higher than the historic lows seen during the pandemic, making it much harder for buyers to qualify for mortgages.

Baron said in his statement he believes home sales “will pick up quickly” when mortgage rates fall.

TRREB CEO John DiMichele added it’s “disappointing” that uninsured mortgage holders coming up for renewal are “still forced to unrealistically qualify at rates approaching eight per cent,” under the stress test, if they want to shop around for a more competitive rate.

He believes the rule should be eliminated for people renewing their mortgages with a different institution.

Over the next three years, mortgages worth more than $900 billion are coming up for renewal, according to a new report from RBC, with some payments rising by half for some borrowers.

Here are the top 5 trending stories of the week:

- Surprising results: Major Canadian regions’ luxury market performance, Sotheby’s reports “The world is going through a lot right now, and Canada’s real estate market is not immune to any of it – from poor or inconsistent economic conditions and rising mortgage rates to serious international conflict and environmental issues. Perhaps surprisingly, then, is the fact that the luxury single-family home market is making a comeback, as Sotheby’s reports.”

- Trudeau’s bashing of real estate investors shows lack of understanding about housing “Canadian mortgage rates are climbing and may be creating a little more stress for borrowers. Equifax data reveals mortgage delinquencies have climbed from record lows in Q2 2023. That may present some concerns, until some context is provided. Yes, the delinquency rate is climbing from lows, but the rates remain much lower than they were pre-pandemic, when interest costs were less than half the current level. “

- Real estate industry facing pushback to longstanding rules setting agent commissions on home sales “A series of court challenges seek to upend longstanding real estate industry practices that determine the commissions agents receive on the sale of a home — and who foots the bill. A federal jury in one of those cases on Tuesday ordered the National Association of Realtors along with some of the nation’s biggest real estate brokerages to pay almost $1.8 billion in damages, after finding they artificially inflated commissions paid to real estate agents.”

- Ontario Removing HST On New Purpose-Built Rentals “In an effort to build more rental housing, the Government of Ontario plans to remove the full provincial portion of the Harmonized Sales Tax (HST) on new purpose-built rentals. The 8% tax will no longer be applied to new purpose-built rental housing, including apartment buildings, student housing, and senior residences built specifically for long-term rental accommodation, that meet certain criteria..”

- State of the condo market: GTA and Vancouver “Despite high carrying costs, condo investors in Vancouver and Toronto are hanging onto their properties. But, it’s often because there are few takers if they try to sell, realtors in both cities say. Listings for investment condos in Vancouver have increased and sales have declined rapidly over the last three or four months, says Jesse Kleine, a realtor with Sutton Group-West Coast Realty in Surrey, BC.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.