MARKET INSIGHT FOR THE WEEK ENDING July 14th , 2023

TRREB Releases 2023 Q2 Condo Market Statistics July 13, 2023

Market conditions in the condominium apartment segment tightened markedly in the second quarter of 2023. Sales were up strongly on a year-over-year basis, whereas the number of new listings was down sharply. With more competition between buyers, average condominium apartment selling prices should climb above last year’s levels in the second half of this year.

“Strong population growth and an extremely competitive rental market have resulted in an increase in condominium apartment sales over the past year. Average condo selling prices remain below last year’s levels, which has helped from an affordability perspective. However, as sales increase relative to the number of listings available, expect condo prices to trend upward in the months ahead,” said Toronto Regional Real Estate Board (TRREB) President Paul Baron.

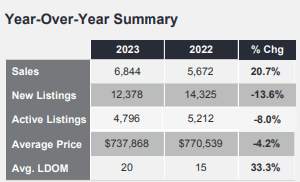

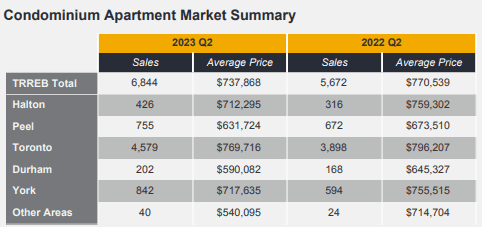

Total condominium apartment sales amounted to 6,844 in Q2 2023 – up by more than 20 per cent on a year-over-year basis. New condo listings were down by more than 13 per cent over the same period. This divergence between condo sales and listings also meant that active listings at the end of Q2 2023 were down by eight per cent compared to the end of Q2 2022.

The average selling price for a condominium apartment GTA-wide was $737,868 in Q2 2023 – down by 4.2 per cent compared to $770,539 in Q2 2022. In the City of Toronto, which accounted for two-thirds of total condo sales, the average selling price was $769,616. This result was down by 3.3 per cent compared to Q2 2022.

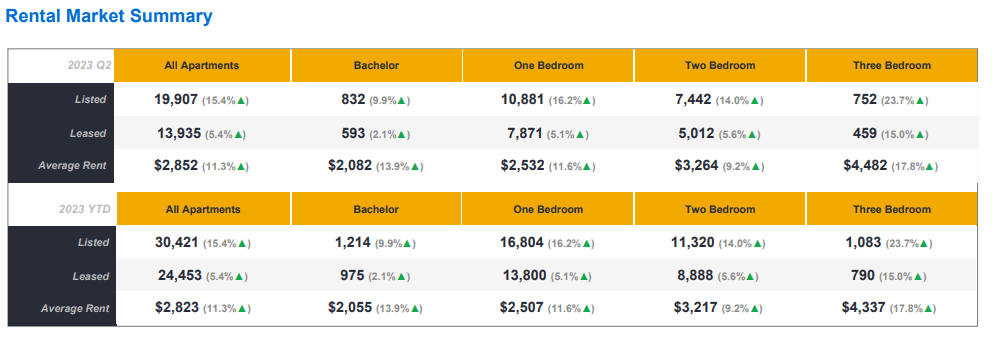

“Average rents have increased well-above the rate of inflation over the past two years – often by double-digit annual rates. Consumer polling conducted for TRREB by Ipsos has shown that these rent increases are pushing households back into the ownership market despite higher borrowing costs. This goes a long way to explaining why condo sales have increased over the past year,” said TRREB Chief Market Analyst Jason Mercer.

Here are the top 5 trending stories of the week:

- Bank of Canada increases interest rate to 5% “The Bank of Canada (BoC) has hiked its key interest rate to 5% from 4.75%, with the Bank Rate at 5.25% and the deposit rate at 5%. In an update on Wednesday morning, the BoC said that though Canada’s economy has been stronger than expected — with more momentum in demand and strong consumption growth at 5.8% in the first quarter — recent retail trade and other data suggest “more persistent excess demand in the economy.”

- Canada’s Rising Unemployment Is A “Foolproof” Recession Signal: BMO “Canada’s economy has been lucky enough to buck recession forecasts, but its luck may be running out. The country’s latest job report showed huge job gains in June. However, it’s the rising unemployment rate that caught the attention of BMO’s chief economist. In a note to investors, they warned the rising rate has a near-foolproof record of forecasting a recession. “

- Where You Can Still Find Affordable Homes In Ontario “The share of disposable income between Canada’s highest and lowest households widened in the first quarter of 2023, according to data released by Statistics Canada. The gap between the top 40 per cent and bottom 40 per cent of household incomes reached 44.7 per cent, marking a 0.2 per cent rise from the same time last year, the findings released on Tuesday showed. The figure was still lower than pre-pandemic levels, which averaged 45.1 per cent from 2010 to 2019, the data revealed. ”

- Rent in this GTA city is $700 lower than in downtown Toronto as prices keep surging “With so many people in Toronto struggling to make ends meet as cost of living in the city keeps rising, leaving for greener (read: cheaper) pastures somewhere else is a very real, perhaps even everyday consideration for some residents. “

- Ontario government says it will help lower home prices but only for one type “Amid endless calls for some kind of government intervention to assuage the housing crisis in the GTA and beyond, the Government of Ontario is now considering helping make some of the province’s homes at least slightly more affordable — but only a certain type.”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.