MARKET INSIGHT FOR THE WEEK ENDING June 23rd , 2023

More And More First-Time Home Buyers Are Getting Help From Family To Cover The Down Payment.

More than a third of homebuyers in the GTA were given a lump sum payment from parents or relatives to purchase their first property and nearly 75 per cent of first-time homebuyers in the GTA worried that their down payment would not be enough, according to a new survey.

The survey results, which were released Thursday, looked at key trends among first-time homebuyers who bought a residence within the last two years.

The biggest hurdle first-time homebuyers face is coming up with a substantial down payment. Using the ‘bank of mom and dad’ for a top-up on a down payment is not uncommon. First-time buyers in the GTA are often dual-income couples in their thirties.

According to the survey, 36 per cent of first-time homebuyers in the GTA say they received a lump sum payment from parents or relatives to purchase a home. About 29 per cent said they received financial help with their monthly mortgage payments.

Forty-four per cent of first-time homebuyers in the GTA said the financial assistance they received was a gift.

About 29 per cent of first-time homebuyers in the GTA said they purchased a home in a different neighbourhood or region than they had originally planned due to affordability issues and 37 per cent said they purchased a smaller home than they had planned.

Canadians continue to face challenges in entering the real estate market, be it high-interest rates, strict mortgage qualification standards, or difficulty saving enough money in a reasonable time period for a down payment.

Still, they continue to prioritize home ownership and view it as a milestone worth achieving. Most buyers surveyed were prepared to settle for what they could afford in order to get into the market.

If their down payment will not get them into their dream home, most buyers are prepared to settle for a smaller property or a condo in order to build equity towards an eventual move-up home.

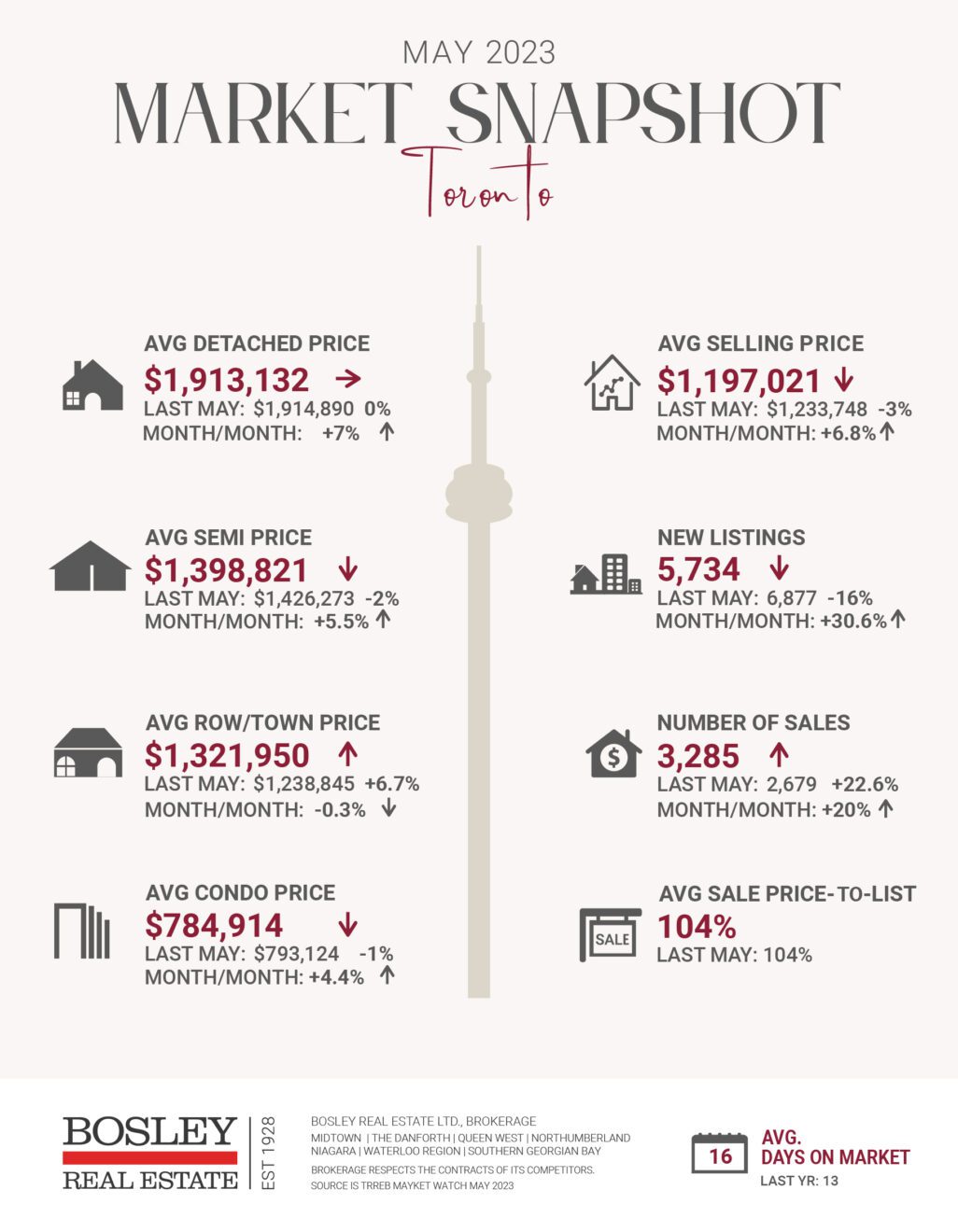

According to the Toronto Regional Real Estate Board, the average price of a home in the GTA reached $1,196,101 in May up from $1,153,269 one month earlier.

Here are the top 5 trending stories of the week:

- Unveiling housing strategies: Toronto’s mayoral candidates’ plans explored for realtors “The Toronto housing crisis is a multifaceted issue that encompasses a range of underlying factors. Rapidly increasing demand, coupled with limited supply, has contributed to soaring housing prices and affordability challenges. As the Toronto mayoral election approaches, I felt compelled to delve into the housing platforms presented by some leading candidates. I believe that the solution does not lie in any individual candidate’s platform but in a synergistic combination of their distinctive proposals. “

- Rebound In The Resale Market” Pushes Canadian Home Prices Up In May “Spring saw Canadian housing markets rebound across the board. In May alone, sales trended upwards in 70% of local markets, and on par with the clear resurgence in demand, home prices rallied. This is reflected in the latest Teranet-National Bank Composite House Price Index, which tracks observed or registered home prices across 11 CMAs: Victoria, Vancouver, Calgary, Edmonton, Winnipeg, Hamilton, Toronto, Ottawa-Gatineau, Montreal, Quebec City, and Halifax. All properties that have been sold at least twice are considered in the calculation of the index.

- Philip Cross: Statistics Canada feeding misperception Canadians on the brink of financial ruin “Earlier this year, a Statistics Canada survey reported 26 per cent of Canadian households said they wouldn’t be able to cover an unexpected bill of $500 if one came along. With prices and interest rates higher now than they were then, that share may even have risen.”

- Changing amortization, cap on insured mortgages not the answer to affordability: CMHC “The head of Canada’s housing agency says measures such as extending mortgage amortizations and changing the threshold to qualify for an insured mortgage are not the answer to the country’s housing affordability challenges. Even though homeowners have seen a rapid increase in what they are paying to cover mortgages as interest rates have risen, Canada Mortgage and Housing Corp. president and chief executive Romy Bowers is not in favour of allowing borrowers to repay their mortgages over longer periods of time.”

- Canada’s construction industry faces severe labour shortage, warns economist “Canada’s construction industry is facing a severe labour shortage that threatens to exacerbate the already pressing housing shortage and affordability crisis, warns a recent report by Benjamin Tal, an economist with CIBC Economics. The report highlights the urgent need for fresh thinking, actionable policies and coordinated efforts between the government and private sector to tackle this multidimensional problem. With estimates suggesting the need for millions of additional housing units, the gap between demand and supply is growing daily without meaningful action..”

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.