MARKET INSIGHT FOR THE WEEK ENDING – April 21st, 2023

The housing market could be gathering steam again – but a notable feature of recent weeks has been a lack of new listings becoming available. This lack of inventory is the main underlying storyline in the Greater Toronto Area (GTA) real estate market. Coming out of the winter months, and with an anticipated increase in demand, and competition among buyers, market watchers project renewed price growth.

Part of the reason for growing demand, especially among first-time buyers, has been a red-hot rental market, as the average rents start to get closer to the cost of ownership, says Toronto Regional Real Estate Board (TRREB) chief market analyst Jason Mercer.

Mercer points to lower inflation and uncertainty in financial markets resulting in medium-term bond yields trending lower, which will impact interest rates. “Mortgage rates will follow that trend in the bond market, with a bit of a lag,” Mercer says. “We are anticipating seeing borrowers getting better terms in the second half of this year. That will help with affordability, and we will see an increase in sales. We will see tighter market conditions and renewed upward pressure on prices.”

New listings in the GTA in March 2023 were at 11,184, down 44.3 per cent compared with the previous March. We are seeing extremely low inventory levels. It’s like a logjam in the marketplace right now. You can’t sell what you don’t have. That rings so true, especially in Toronto, where there are a lot of people that would like to move right now but there’s just not the product available to stimulate the activity.

There are also signs of optimism and improved consumer confidence as the market starts to return to its familiar footing. Maybe we are seeing a positive psychological impact on the market from the March announcement by the Bank of Canada that it would hold interest rates at 4.5 per cent. People had been beaten down over the year by steadily rising rates, rising inflation, and negative real estate market news.

Buyers are now emerging, with plenty of showings on properties and multiple-offer scenarios have returned, especially in certain central neighbourhoods. The activity is there but the product isn’t. That is discouraging for a lot of people. Buyers would love to move but they just can’t find what they want.

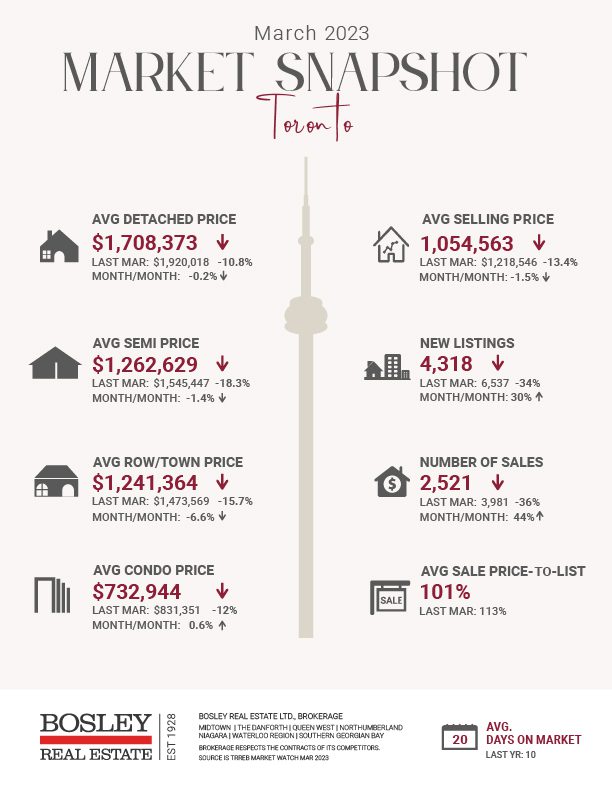

TRREB reported that sales across the GTA were down 36.5 per cent compared with March 2022. Buyers and sellers are still confused or somewhat concerned about where the market is, especially when they look at dramatic year-over-year drop-offs, as opposed to month-over-month prices and number of transactions.

Those are up when you look at TREBB data. The average price in the GTA in March 2023 was $1,108,606, down considerably compared with $1,298,666 in March 2022, but up from the average price in February of this year, which was $1,095,617. There were 4,783 transactions in February, and 6,896 in March.

As always, low supply and pent-up demand is driving all of this, but if these patterns continue, a certain reliable stability is established and assumed, which then feeds back into confidence. Barring any unforeseen major upsets in the world at large, we have ourselves a swift and strong Toronto market this spring.

Here are the top 5 trending stories of the week:

- Toronto Real Estate Is Still The King of Cranes, 4x More Than The Next City “There was a Toronto real estate slowdown? Hard to notice with busy construction sites blanketing the city. The latest RLB Crane Index, tracking 14 key North American cities, shows crane use grew in Q1 2023. Toronto remains the reigning king of cranes, with almost 5x more than the next city on the list.”

- City Report Calls for Zoning Amendments to Allow 4-Unit Multiplexes in Every Neighbourhood “The City of Toronto will consider a move to allow multiplexes city-wide as part of a plan to get more homes built. A City staff report going before the Planning and Housing Committee next week is recommending amendments to the City’s Official Plan and Zoning Bylaw that would allow for the low-rise housing type, up to four units, in all neighbourhoods across the city.”

- Toronto home prices are expected to leap even higher than experts thought this year “Phil Soper, president and CEO of Royal LePage, says that “sanity is slowly returning to the [Canadian] housing market” after a turbulent few years, and the mass resurgence of hibernating buyers has forced experts to adjust their forecasts for GTA housing, expecting higher prices than initially anticipated for the fourth quarter of 2023.”

- Canadian Real Estate Markets Saw Prices Rise Up To $42k In A Month

“Canada’s credit-crazy real estate buyers have flooded the market once again. Canadian Real Estate Association (CREA) data shows a benchmark, or typical, home rose in March 2023. Breaking the data down by market, most saw substantial increases. One market even saw prices rip over $40k higher over a span of just 31 days.” - Future City – Seven of Toronto’s most high-tech, sustainable and exciting new residential developments

“Waterfront Toronto aims to fix the bland industrial stretch at Queen’s Quay and Parliament Street with an ambitious net-zero mega-development. Quayside will consist of six plant-drenched residential buildings, an urban farm and a stroll-worthy boardwalk.

The Bosley Advantage

Read about the heritage and innovation that form the foundation for Bosley’s industry-leading approach to real estate.